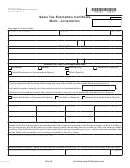

Form Dr 0563 - Sales Tax Exemption Certificate Multi-Jurisdiction Page 2

ADVERTISEMENT

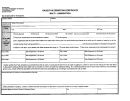

TO OUR CUSTOMERS:

In order to comply with the majority of state and local sales tax law requirements, it is necessary that we have in our files a properly

executed exemption certificate from all of our customers who claim sales tax exemption. If we do not have this certificate, we are

obligated to collect the tax for the state in which the property is delivered.

If you are entitled to sales tax exemption, please complete the certificate and send it to us at your earliest convenience. If you purchase

tax free for a reason for which this form does not provide, please send us your special certificate or statement.

*LESSOR: A form DR 0440, “Permit to Collect Sales Tax on the Rental or Lease Basis” must be completed and submitted to the

Department of Revenue for approval.

CAUTION TO SELLER: In order for the certificate to be accepted in good faith by the seller, the seller must exercise care that the

property being sold is of a type normally sold wholesale, resold, leased, rented, or utilized as an ingredient or component part of a

product manufactured by the buyer in the usual course of his business. A seller failing to exercise due care could be held liable for the

sales tax due in some states or cities.

Misuse of this certificate by the seller, lessor, buyer, lessee, or the representative thereof may be punishable by fine, imprisonment or

loss of right to issue certificates in some states or cities.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2