Form Ct-1120 Dwc - Displaced Worker Tax Credits - 2013

ADVERTISEMENT

Department of Revenue Services

2013

State of Connecticut

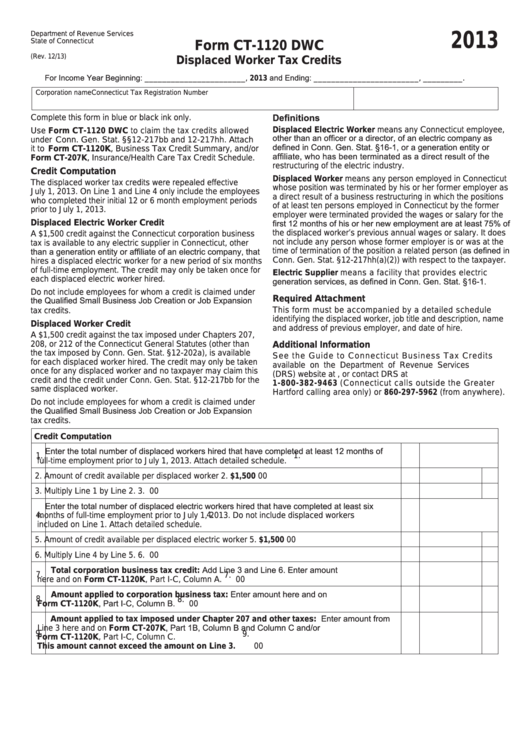

Form CT-1120 DWC

(Rev. 12/13)

Displaced Worker Tax Credits

For Income Year Beginning: _______________________ , 2013 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Definitions

Complete this form in blue or black ink only.

Displaced Electric Worker means any Connecticut employee,

Use Form CT-1120 DWC to claim the tax credits allowed

other than an officer or a director, of an electric company as

under Conn. Gen. Stat. §§12-217bb and 12-217hh. Attach

defined in Conn. Gen. Stat. §16-1, or a generation entity or

it to Form CT-1120K, Business Tax Credit Summary, and/or

affiliate, who has been terminated as a direct result of the

Form CT-207K, Insurance/Health Care Tax Credit Schedule.

restructuring of the electric industry.

Credit Computation

Displaced Worker means any person employed in Connecticut

The displaced worker tax credits were repealed effective

whose position was terminated by his or her former employer as

July 1, 2013. On Line 1 and Line 4 only include the employees

a direct result of a business restructuring in which the positions

who completed their initial 12 or 6 month employment periods

of at least ten persons employed in Connecticut by the former

prior to July 1, 2013.

employer were terminated provided the wages or salary for the

first 12 months of his or her new employment are at least 75% of

Displaced Electric Worker Credit

the displaced worker’s previous annual wages or salary. It does

A $1,500 credit against the Connecticut corporation business

not include any person whose former employer is or was at the

tax is available to any electric supplier in Connecticut, other

time of termination of the position a related person (as defined in

than a generation entity or affiliate of an electric company, that

Conn. Gen. Stat. §12-217hh(a)(2)) with respect to the taxpayer.

hires a displaced electric worker for a new period of six months

of full-time employment. The credit may only be taken once for

Electric Supplier means a facility that provides electric

each displaced electric worker hired.

generation services, as defined in Conn. Gen. Stat. §16-1.

Do not include employees for whom a credit is claimed under

Required Attachment

the Qualified Small Business Job Creation or Job Expansion

This form must be accompanied by a detailed schedule

tax credits.

identifying the displaced worker, job title and description, name

Displaced Worker Credit

and address of previous employer, and date of hire.

A $1,500 credit against the tax imposed under Chapters 207,

208, or 212 of the Connecticut General Statutes (other than

Additional Information

the tax imposed by Conn. Gen. Stat. §12-202a), is available

See the Guide to Connecticut Business Tax Credits

for each displaced worker hired. The credit may only be taken

available on the Department of Revenue Services

once for any displaced worker and no taxpayer may claim this

(DRS) website at , or contact DRS at

credit and the credit under Conn. Gen. Stat. §12-217bb for the

1-800-382-9463 (Connecticut calls outside the Greater

same displaced worker.

Hartford calling area only) or 860-297-5962 (from anywhere).

Do not include employees for whom a credit is claimed under

the Qualified Small Business Job Creation or Job Expansion

tax credits.

Credit Computation

Enter the total number of displaced workers hired that have completed at least 12 months of

1.

1.

full-time employment prior to July 1, 2013. Attach detailed schedule.

2. Amount of credit available per displaced worker

2.

$1,500

00

3. Multiply Line 1 by Line 2.

3.

00

Enter the total number of displaced electric workers hired that have completed at least six

4.

4.

months of full-time employment prior to July 1, 2013. Do not include displaced workers

included on Line 1. Attach detailed schedule.

5. Amount of credit available per displaced electric worker

5.

$1,500

00

6. Multiply Line 4 by Line 5.

6.

00

Total corporation business tax credit: Add Line 3 and Line 6. Enter amount

7.

7.

here and on Form CT-1120K, Part I-C, Column A.

00

Amount applied to corporation business tax: Enter amount here and on

8.

8.

Form CT-1120K, Part I-C, Column B.

00

Amount applied to tax imposed under Chapter 207 and other taxes: Enter amount from

Line 3 here and on Form CT-207K, Part 1B, Column B and Column C and/or

9.

9.

Form CT-1120K, Part I-C, Column C.

This amount cannot exceed the amount on Line 3.

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1