Schedule CT301-PC Instructions

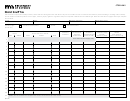

Use Form CT301-PC, Premium Cigar Tax Multiple

Schedule 1

Schedule 3

Schedule, to report purchases, credits, and sales.

Taxable Purchases/Sales

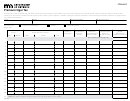

Out-of-State Sales (Resident Distributors Only)

Report all premium cigars on an invoice as one line item if

Report sales in the month that the cigars were removed from

Premium cigars that should be included on this schedule are

they meet the minimum cap threshold.

your premises.

defined as:

Resident distributors. Itemize all untaxed cigar purchases

Itemize all sales of cigars shipped out-of-state during the

• hand-constructed

received during the month. When you complete the sched-

month.

• has a wrapper made entirely from whole tobacco leaf

ule, enter the cigars as shown on the purchase invoices.

Enter total out-of-state sales on line 17. Report this total on

• has a filler and binder made entirely of tobacco, except

Don’t enter net amounts which reflect shortages or overages.

line 10 of Form CT301.

for adhesives or other materials used to maintain the

If you’re shorted merchandise, enter the amount shorted on

When you file your Form CT301, include a copy of Form

size, texture, or flavor, and

Schedule 2 as appropriate. If you received more merchan-

CT301-PC and required sales invoices and credit memos.

• has a wholesale price of $2.00 or more.

dise than you ordered, enter the amount on a separate line of

Schedule 1.

Questions?

Type of Schedule

Enter the total cigar amount on line 17. Report this total on

Website:

There are three schedule types on this form

line 8 of Form CT301, Tobacco Tax Monthly Return.

Email:

cigarette.tobacco@state.mn.us

Schedule 1: Taxable Purchases/Sales into Minnesota

Nonresident distributors. Itemize all cigar products that

Fax:

651-556-5236

you sold into Minnesota during the month. Report returns

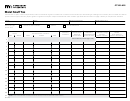

Schedule 2: Credits

Phone:

651-556-3035, weekdays from

you received from Minnesota customers as a negative sale

Schedule 3: Out-of-State Sales

8 a.m. to 4:30 p.m.

on Schedule 1. Enter the total cigar amount on line 17. Re-

This material is available in alternate for mats.

port this total on line 8 of Form CT301.

Check one Schedule Type box to indicate what you’re

reporting (e.g., check the box for Schedule 1 if you’re a

Definition of Wholesale Sales Price.“Wholesale sales

resident distributor reporting taxable purchases). You must

price” is the price at which a distributor purchases a tobacco

complete a separate form for each schedule type.

product. Wholesale sales price includes applicable federal

excise tax, freight charges, or packaging costs, regardless of

Resident Distributor- Fill out Schedule Types 1, 2 & 3

whether they were included in the purchase price.

Nonresident Distributor- Fill out Schedule Type 1 only

Schedule 2

Credits (Resident Distributors Only)

“Credits” are cigars you sold to exempt organizations or

returned to the manufacturer.

Enter cigars that you sold to exempt organizations during

the month (e.g., federal military bases, federal prisons). Also

enter cigars that you returned to the manufacturer during the

month. You must receive a credit memo from the manufac-

turer before you can claim credit for any returned or short-

shipped products. Include copies of sales invoices and credit

memos with this form. Enter total credits on line 17. Report

this total on line 9 of Form CT301.

1

1 2

2