Schedule CT301-MS Instructions

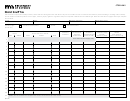

Use Form CT301-MS, Moist Snuff Tax Multiple

Schedule 1

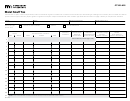

Schedule 3

Schedule, to report purchases, credits, and sales.

Taxable Purchases/Sales

Out-of-State Sales (Resident Distributors Only)

Resident distributors. Itemize all untaxed moist snuff pur-

Report sales in the month that the moist snuff was removed

Type of Schedule

chases you received during the month. This includes all free

from your premises.

There are three schedule types on this form

samples and promotional products.

Itemize all sales of moist snuff shipped out-of-state during

Schedule 1: Taxable Purchases/Sales into Minnesota

When you complete Schedule 1, enter the moist snuff as

the month.

shown on the purchase invoices.

Enter total out-of-state sales on line 17. Report this total on

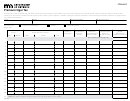

Schedule 2: Credits

Enter the total moist snuff purchases on line 17. Report this

line 15 of Form CT301.

Schedule 3: Out-of-State Sales

total on line 13 of Form CT301, Tobacco Tax Monthly Return.

When you file your Form CT301, include a copy of Form

Nonresident distributors. Itemize all untaxed moist snuff

Check one Schedule Type box to indicate what you’re report-

CT301-MS and required sales invoices and credit memos.

ing (For example, check the box for Schedule 1 if you’re a

products that you sold into Minnesota during the month.

Questions?

resident distributor reporting taxable purchases). You must

Report returns you received from Minnesota customers as a

complete a separate form for each schedule type.

negative sale on Schedule 1. Enter the total moist snuff sales

Website:

on line 17. Report this total on line 13 of Form CT301.

Email:

cigarette.tobacco@state.mn.us

Resident Distributor- Fill out Schedule Types 1, 2 & 3

Definition of Wholesale Sales Price.“Wholesale sales price”

Fax:

651-297-1939

Nonresident Distributor- Fill out Schedule Type 1 only

is the price at which a distributor purchases a tobacco prod-

Phone:

651-556-3035, weekdays from

uct. Wholesale sales price includes applicable federal excise

8 a.m. to 4:30 p.m.

Moist Snuff Tax Rate and Definition

tax, freight charges, or packaging costs, regardless of whether

Mail:

Cigarette and Tobacco Tax

The excise tax on “moist snuff ” is 95 percent of the wholesale

they were included in the purchase price.

Minnesota Department of Revenue

sales price or $3.04 per container, whichever is greater.

Mail Station 3331

Schedule 2

Moist snuff is any finely cut, ground, or powdered smokeless

St. Paul, MN 55146-3331

tobacco that is intended to be placed or dipped in the mouth.

Credits (Resident Distributors Only)

“Credits” are moist snuff that you sold to exempt organiza-

A container of moist snuff is the smallest consumer-size can,

tions or returned to the manufacturer.

package, or other container that is marketed or packaged by

Enter moist snuff that you sold to exempt organizations like

the manufacturer, distributor, or retailer for separate sales

federal military bases or federal prisons during the month.

to a retail or consumer customer. Each container which is

Also enter moist snuff that you returned to the manufacturer

part of a group that is combined or packaged together will be

during the month. You must receive a credit memo from the

tracked and subject to tax.

manufacturer before you can claim credit for any returned or

short-shipped products. Include copies of the sales invoices

and credit memos with this form. Enter total credits on line

17. Report this total on line 14 of Form CT301.

1

1 2

2