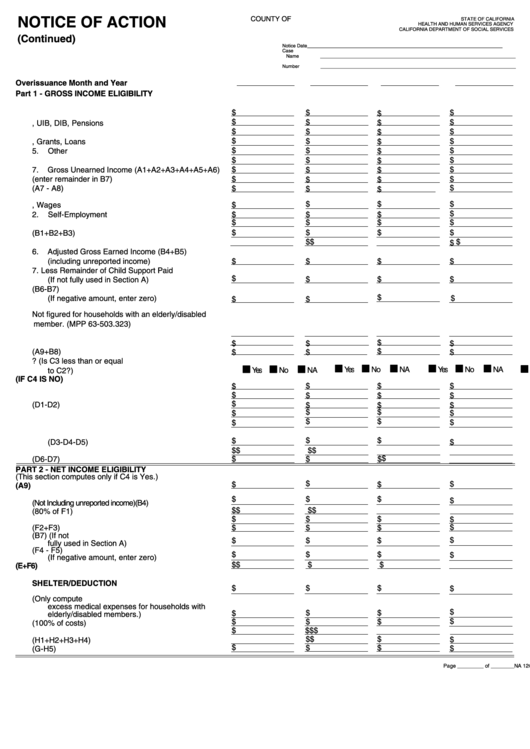

NOTICE OF ACTION

COUNTY OF

STATE OF CALIFORNIA

HEALTH AND HUMAN SERVICES AGENCY

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

(Continued)

Notice Date

_________________________________________________________________________

Case

Name

_________________________________________________________________________

Number

_________________________________________________________________________

Overissuance Month and Year

Part 1 - GROSS INCOME ELIGIBILITY

A. NONEXEMPT GROSS UNEARNED INCOME

$

$

$

$

1.

Cash Aid

$

$

$

$

2.

Social Security, UIB, DIB, Pensions

$

$

$

$

3.

Child/Spousal Support

$

$

$

4.

Scholarships, Grants, Loans

$

$

$

$

5.

Other

$

$

6.

Unreported Gross Unearned Income

$

$

$

$

$

7.

Gross Unearned Income (A1+A2+A3+A4+A5+A6)

$

$

8.

Less Child Support Paid (enter remainder in B7)

$

$

$

$

$

9.

Total Gross Unearned Income (A7 - A8)

$

$

$

B. NONEXEMPT GROSS EARNED INCOME

$

$

$

$

1.

Gross Salary, Wages

$

2.

Self-Employment

$

$

$

$

$

$

$

3.

Training Allowance

$

$

$

$

4.

Gross Earned Income (B1+B2+B3)

$

$

$

5.

Unreported Gross Earned Income

$

6.

Adjusted Gross Earned Income (B4+B5)

(including unreported income)

$

$

$

$

7.

Less Remainder of Child Support Paid

$

$

(If not fully used in Section A)

$

$

8.

Total Gross Earned Income (B6-B7)

$

(If negative amount, enter zero)

$

$

$

C. GROSS INCOME TEST

Not figured for households with an elderly/disabled

member. (MPP 63-503.323)

1.

Household size

2.

Maximum Gross Income Allowed from table

$

$

$

$

$

3.

Total Countable Gross Monthly Income (A9+B8)

$

$

$

4.

Gross Income eligible? (Is C3 less than or equal

■ ■

■ ■

■ ■

■ ■

■ ■

■ ■

■ ■

■ ■

■ ■

■ ■

■ ■

■ ■

Yes

No

NA

Yes

No

NA

to C2?)

Yes

No

NA

Yes

No

NA

D. GROSS INCOME OVERISSUANCE (IF C4 IS NO)

1.

Amount Previously Issued

$

$

$

$

$

2.

Correct Benefit

$

$

$

$

3.

Total CalFresh Overissuance (D1-D2)

$

$

$

$

$

$

$

4.

Minus Lost Benefits Not Restored

$

$

$

$

5.

Minus Payment Received

6.

Amount of Overissuance to be Collected

$

$

$

(D3-D4-D5)

$

$

$

$

$

7.

Minus Workfare Offset

$

8.

Amount of Overissuance to be Collected (D6-D7)

$

$

$

PART 2 - NET INCOME ELIGIBILITY

(This section computes only if C4 is Yes.)

$

$

$

$

E.

NONEXEMPT GROSS UNEARNED INCOME (A9)

F.

NONEXEMPT GROSS EARNED INCOME

$

$

$

$

1.

Gross Earned Income(Not Including unreported income)(B4)

$

$

$

$

2.

Adjusted Gross Earned Income (80% of F1)

$

$

$

$

3.

Unreported Gross Earned Income

$

4.

Total Countable Earned Income (F2+F3)

$

$

$

5.

Less remainder of Child Support Paid (B7) (If not

$

$

$

$

fully used in Section A)

6.

Total Gross Earned Income (F4 - F5)

$

$

$

$

(If negative amount, enter zero)

$

$

$

$

G. TOTAL NONEXEMPT GROSS INCOME (E+F6)

H. STANDARD/DEPENDENT CARE/HOMELESS

SHELTER/DEDUCTION

$

$

$

$

1.

Standard Deduction

2.

Excess Medical Expenses (Only compute

excess medical expenses for households with

$

$

$

$

elderly/disabled members.)

$

$

$

$

3.

Dependent Care (100% of costs)

$

$

$

$

4.

Homeless Shelter Deduction

$

$

$

$

5.

Total Deductions (H1+H2+H3+H4)

$

$

$

$

6.

Total Adjusted Income (G-H5)

NA 1263 (8/11) CONTINUATION PAGE

Page _________ of ________

1

1 2

2