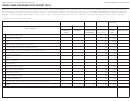

PAYROLL & FRINGE BENEFIT REPORT (SR 4)

PURPOSE:

The Payroll and Fringe Benefit Report (SR 4) captures actual allowable and reasonable costs on payroll and fringe benefits of the Group Home

Program.

INSTRUCTIONS FOR COMPLETION:

Submit one report per group home program. Report all amounts to the nearest whole dollar amount.

Corporate/Licensee Name: Enter the Licensee name shown on the most recent Group Home Program Rate Application (SR 1).

Corporate Number: Enter the corporate number issued by the California Secretary of State.

Program Number: Enter number previously assigned by the Department or specify “No number assigned yet.”

Reporting Period:

For an existing provider, each Payroll & Fringe Benefit Report shall be based on actual fiscal data consistent with the provider’s

most recent fiscal year. For the reporting period enter the first month and year and the last month and year for the fiscal year. For a new provider, enter

data from the first month of operation through the last month of the provider’s fiscal year and enter the months for the time period covered in the space

provided.

Number of months in cost report period: Enter the number of months for the cost period. For a full fiscal year, enter “12”.

I.

PAYROLL (DO NOT INCLUDE BENEFITS):

Enter the total payroll for child care and supervision under column 1. Enter the total payroll for

social work activities under column 2.

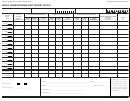

II.

FRINGE BENEFIT EXPENSE:

Line 1.

FICA Employer Tax:

Enter the total FICA Employer Tax (including MEDICARE) for child care and supervision under column 1. Enter the

total FICA Employer Tax (including MEDICARE) for social work activities under column 2.

Line 2.

Unemployment Coverage:

Enter the total unemployment coverage for child care and supervision under column 1. Enter the total

unemployment coverage for social work activities under column 2. (For example:

State Unemployment Insurance, State Employment

Training Tax and Federal Unemployment Insurance.)

Line 3.

Workers’ Compensation Insurance:

Enter workers’ compensation insurance for child care and supervision under column 1. Enter workers’

compensation insurance for social work activities under column 2.

Line 4.

Medical Insurance Expense:

Enter the medical insurance expense for child care and supervision under column 1. Enter the medical

insurance expense for social work activities under column 2. (Include medical, dental and optical plans paid for the employee by the program.)

Line 5.

Retirement:

Enter the employer’s contributions to a retirement plan for employees for child care and supervision under column 1. Enter the

employers contributions to a retirement plan for employees for social work activities under column 2.

Line 6.

Other:

Include such items as employer-paid disability insurance, life insurance, housing allowance and the like. Enter the benefits for child

care and supervision under column 1. Enter the benefits for social work activities under column 2.

TOTAL FRINGE BENEFITS:

Add lines 1 through 6 for child care and supervision and enter under column 1. Add lines 1 through 6 for social work

activities and enter under column 2.

:

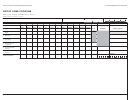

III.

TOTAL PAYROLL & FRINGE BENEFITS

Add the payroll and total fringe benefits for child care and supervision and enter under column 1.

Add the payroll and total fringe benefits for social work activities and enter under column 2.

IV.

CONTRACTOR COSTS:

Enter contractor costs for social work activities under column 2.

V.

TOTAL:

“Total” must be carried over to Column A, Lines 1 and 2 of the Group Home Program Cost Report (SR 3).

SR 4 (12/04)

1

1 2

2