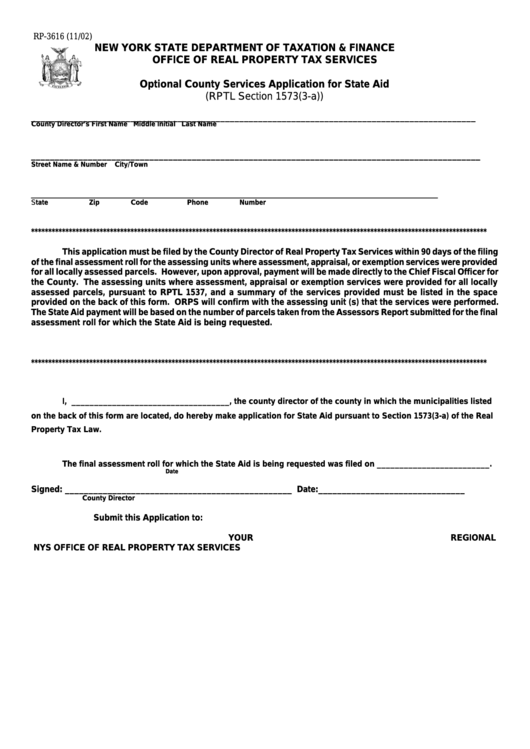

RP-3616 (11/02)

NEW YORK STATE DEPARTMENT OF TAXATION & FINANCE

OFFICE OF REAL PROPERTY TAX SERVICES

Optional County Services Application for State Aid

(RPTL Section 1573(3-a))

______________________________________________________________________________________________

County Director’s First Name

Middle Initial

Last Name

_______________________________________________________________________________________________

Street Name & Number

City/Town

________________________________________________________________________________________________________

State

Zip Code

Phone Number

*************************************************************************************************************************************

This application must be filed by the County Director of Real Property Tax Services within 90 days of the filing

of the final assessment roll for the assessing units where assessment, appraisal, or exemption services were provided

for all locally assessed parcels. However, upon approval, payment will be made directly to the Chief Fiscal Officer for

the County. The assessing units where assessment, appraisal or exemption services were provided for all locally

assessed parcels, pursuant to RPTL 1537, and a summary of the services provided must be listed in the space

provided on the back of this form. ORPS will confirm with the assessing unit (s) that the services were performed.

The State Aid payment will be based on the number of parcels taken from the Assessors Report submitted for the final

assessment roll for which the State Aid is being requested.

*************************************************************************************************************************************

I, ___________________________________, the county director of the county in which the municipalities listed

on the back of this form are located, do hereby make application for State Aid pursuant to Section 1573(3-a) of the Real

Property Tax Law.

The final assessment roll for which the State Aid is being requested was filed on _________________________.

Date

Signed: ________________________________________________ Date:_______________________________

County Director

Submit this Application to:

YOUR REGIONAL

NYS OFFICE OF REAL PROPERTY TAX SERVICES

1

1 2

2

![Form Rp-466-b [chautauqua, Oswego]- Application For Volunteer Firefighters / Ambulance Workers Exemption In Certain Additional Counties - 2007 Form Rp-466-b [chautauqua, Oswego]- Application For Volunteer Firefighters / Ambulance Workers Exemption In Certain Additional Counties - 2007](https://data.formsbank.com/pdf_docs_html/198/1984/198464/page_1_thumb.png)