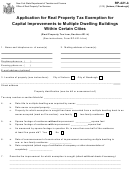

RP-421-m (2/12) (back)

7.

Residential attributes of the improvement

a) Is the multiple dwelling occupied or to be occupied as the residence of three or more families living

independently of one another? Yes

No

b) Is any portion of the multiple dwelling used as a hotel? Yes

No

c) Number of dwelling units in building: _____

d) Number of which are affordable dwelling units (see instructions for definition): ______

Attach the report of the municipal agency or officer that verified that the project is in compliance with the

affordable housing requirement. That verification must be done in accordance with procedures established

by the New York State Division of Housing and Community Renewal.

8. Use of property

a. Area of building improvement: _______ square feet

b. Area of building improvement in multiple dwelling use, exclusive of commercial and other uses:

_______ square feet

9. Is the property currently receiving any other exemption from real property taxation? Yes

No

10. Expected date of completion of improvement (attach copy of certificate of occupancy or other

documentation of completion): _____________________

Certification

I, ____________________________________, hereby certify that the information on this application and any

accompanying pages constitutes a true statement of facts.

_____________________________________________

______________________

Signature

Date

For Assessor’s Use

1. Date application filed: ____________

2. Applicable taxable status date: ________________

3. Action on application:

Approved

Disapproved

4. Assessed valuation of parcel in first year of exemption: $ _______________________

5. Increase in total assessed valuation in first year of exemption: $ ______________________

6. Amount of exemption in first year:

Percent

Amount

County

__________________

$ __________________

City/Town

__________________

$ __________________

Village

__________________

$ __________________

School District

__________________

$ __________________

______________________________________________

_________________________

Assessor’s signature

Date

Clear Form

1

1 2

2