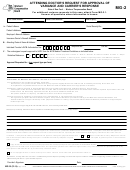

2

RP-305-r-ws (1/96)

WORKSHEET FOR APPORTIONMENT OF FARM ASSESSMENT

ACRES

LAND

IMPROVEMENTS

TOTAL

A. Total Assessment

$

$

$

B. Assessed Value of Parcel Excluding Eligible

Agricultural Land

1.

Owner’s residence and associated land

_________

$_____________

$________________

$______________

2.

Farm Structures (barns and other farm

improvements including fruit tree/vine

support structures) not qualified for RPTL

483 exemption................................

…………..

…………………

$________________

$______________

3.

Other structures (processing plant, retail

store, etc.) ...........................................

_________

$________________

$______________

4.

Ineligible land (include excess

woodland acreage)

_________

$_____________

$______________

5.

Total (lines 1, 2, 3 and 4)

_________

$______________

C. Agricultural Assessment of Parcel

1.

Assessed value of eligible land before

agricultural assessment

(Total of line A minus line B5)

$______________

2.

Assessed value of fruit tree/vine support

structures on eligible land not qualified for

RPTL 483 exemption

$______________

3.

Total lines C1 and C2

$______________

4.

Total agricultural assessment on eligible

land (from Page 4)

$______________

5.

Excess Value, if any (line 3 minus line 4)

$______________

D. Total Taxable Assessment Before Adjustment

for Other Exemptions (line B5 plus line C1 or

B5 plus line C4, whichever is lower)

$______________

E. Other Exemptions

1.

Veterans

$______________

2.

RPTL 483 New Construction

$______________

3.

RPTL 483-a

$______________

4.

Other

$______________

6.

Total

$______________

7.

F. Total Taxable Assessed Value

(line D minus line E5)

$______________

G. 1. • Application Approved

2. • Approved as Modified

3. • Disapproved

Reason for Modification or Disapproval ___________________________________________________________

____________________________________________________________________________________________

Amount of Exemption (from line C5 of Apportionment Worksheet above)

Enter this amount in exempt column of assessment roll, and on top of page 1, $_______________

Clear Form

1

1 2

2