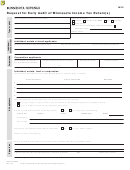

Form M22 Instructions

Do not file your request for early

How to File

Need Help?

audit before you file your income

Complete a separate Form M22 for each

If you need help to complete this form,

early audit request.

write to one of the addresses listed in the

tax return.

previous section. Or send your questions to

Send the original and one copy of this

one of the following email addresses:

form with your final return to the depart-

Purpose of An Early Audit

ment at the proper address below. The

• individual.incometax@state.mn.us for

Request

department will enter the expiration date on

individuals and requests for individual

The Minnesota Department of Revenue

the front of one copy and return it to you.

bankruptcies

normally has three and one-half years after

• businessincome.tax@state.mn.us for

you file an income tax return in which to

Where to Send

estates, trusts, corporations and requests

assess any additional taxes that you may

for corporate bankruptcies.

Individuals:

owe. An early audit request reduces that

time limit to 18 months from the time your

Information is available in alternative

Minnesota Department of Revenue

request is received by the department.

formats upon request for persons with dis-

Mail Station 7703

abilities.

St. Paul, MN 55146-7703

Normally the department must start any

legal action within five years from the date

Requests for individual bankruptcies,

Reporting Federal Changes

of assessment to collect taxes owed. That

estates and trusts:

If the IRS changes your federal tax or you

five-year period would be reduced to two

Minnesota Department of Revenue

file an amended federal return and it affects

years if your request is approved.

Mail Station 4113

your Minnesota return, you have 180 days

St. Paul, MN 55146-4113

to file an amended return with the depart-

Bankruptcy

ment.

Corporations and requests for corporate

Form M22 should be used by the trustee to

bankruptcies:

file an early audit request under 11 U.S.C.

If the federal changes or amended return

505(b). Such a request will be considered a

does not affect your Minnesota return, you

Minnesota Department of Revenue

request for the time limits of 505(b).

have 180 days to send a letter explaining

Mail Station 5130

why the federal audit or amended return

St. Paul, MN 55146-5130

does not affect your Minnesota return. Send

Who May Request

Mining companies:

your letter and a complete copy of your

An early audit request may be made by:

federal amended return or the correction

Minnesota Department of Revenue

• the personal representative or admin-

notice you received from the IRS to the

Mail Station 3331

istrator of a deceased person’s estate if

department at the appropriate address in the

St. Paul, MN 55146-3331

the request is made during the period of

“Where to send” section.

administration of the estate (applies only

If you fail to report as required, a 10

to Form M1, Individual Income Tax, or

percent penalty will be assessed on any

Form M2, Income Tax Return for Estates

additional tax.

and Trusts (Fiduciaries)—not Form

M706, Estate Tax Return),

If any amounts of income, tax preferences,

deductions or credits are changed or cor-

• a bankruptcy trustee,

rected by the IRS or if you file an amended

• the trustee of a terminating trust or other

federal return, the department may re-

fiduciary who has custody of the assets,

compute or reassess tax due within one

or

year after you notify the department of the

• a corporation or mining company if it:

federal changes. If you believe the federal

changes are wrong, please explain on a

— is considering dissolution by the end

separate sheet.

of the 18-month period covered by

the early audit request,

— began the dissolution by the end of

the 18-month period, or

— completed the dissolution by the end

of the 18-month period.

1

1 2

2