Form 928 - Taxable Fuel Bond

Download a blank fillable Form 928 - Taxable Fuel Bond in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 928 - Taxable Fuel Bond with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

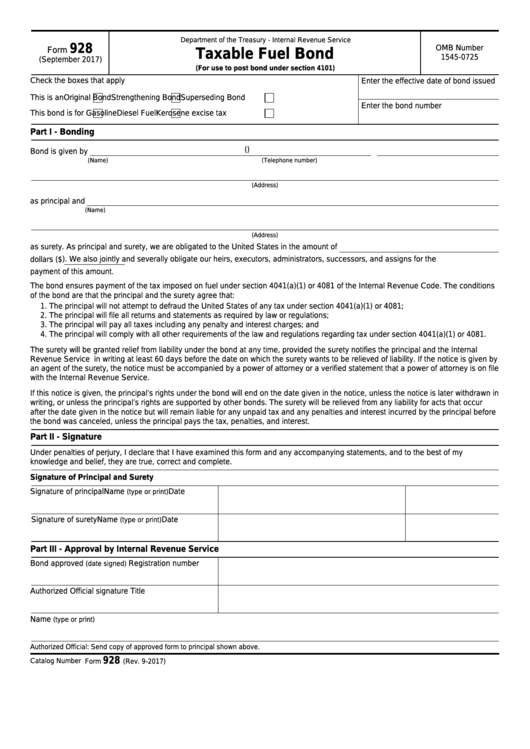

Department of the Treasury - Internal Revenue Service

928

OMB Number

Form

Taxable Fuel Bond

1545-0725

(September 2017)

(For use to post bond under section 4101)

Check the boxes that apply

Enter the effective date of bond issued

This is an

Original Bond

Strengthening Bond

Superseding Bond

Enter the bond number

This bond is for

Gasoline

Diesel Fuel

Kerosene excise tax

Part I - Bonding

(

)

Bond is given by

(Telephone number)

(Name)

(Address)

as principal and

(Name)

(Address)

as surety. As principal and surety, we are obligated to the United States in the amount of

dollars ($

). We also jointly and severally obligate our heirs, executors, administrators, successors, and assigns for the

payment of this amount.

The bond ensures payment of the tax imposed on fuel under section 4041(a)(1) or 4081 of the Internal Revenue Code. The conditions

of the bond are that the principal and the surety agree that:

1. The principal will not attempt to defraud the United States of any tax under section 4041(a)(1) or 4081;

2. The principal will file all returns and statements as required by law or regulations;

3. The principal will pay all taxes including any penalty and interest charges; and

4. The principal will comply with all other requirements of the law and regulations regarding tax under section 4041(a)(1) or 4081.

The surety will be granted relief from liability under the bond at any time, provided the surety notifies the principal and the Internal

Revenue Service in writing at least 60 days before the date on which the surety wants to be relieved of liability. If the notice is given by

an agent of the surety, the notice must be accompanied by a power of attorney or a verified statement that a power of attorney is on file

with the Internal Revenue Service.

If this notice is given, the principal’s rights under the bond will end on the date given in the notice, unless the notice is later withdrawn in

writing, or unless the principal’s rights are supported by other bonds. The surety will be relieved from any liability for acts that occur

after the date given in the notice but will remain liable for any unpaid tax and any penalties and interest incurred by the principal before

the bond was canceled, unless the principal pays the tax, penalties, and interest.

Part II - Signature

Under penalties of perjury, I declare that I have examined this form and any accompanying statements, and to the best of my

knowledge and belief, they are true, correct and complete.

Signature of Principal and Surety

Signature of principal

Name

Date

(type or print)

Signature of surety

Name

Date

(type or print)

Part III - Approval by Internal Revenue Service

Bond approved

Registration number

(date signed)

Authorized Official signature

Title

Name

(type or print)

Authorized Official: Send copy of approved form to principal shown above.

928

Catalog Number 16984Z

Form

(Rev. 9-2017)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2