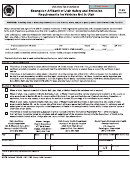

Form MWR Instructions

Instructions for Employees

Minnesota has income tax reciprocity agreements with Michigan and North Dakota. These agreements only cover personal service income

such as wages, bonuses, tips, and commissions.

Every year, fill out this form and give it to each Minnesota employer if all of the following apply:

•

You are a resident of Michigan or North Dakota

•

You return to your residence in that state at least once a month

•

You do not want Minnesota income tax withheld from your wages

Give the completed form to your employer by the later of the following:

•

February 28

•

30 days after you begin working or change your permanent residence

If you complete and submit Form MWR, you do not need to complete form W-4MN, Minnesota Employee Withholding/Exemption Certifi-

cate, to claim exemption from Minnesota withholding tax.

Fill Out the Form Completely

If you do not fill in every item on this form or do not give the form to your employer by the due date, your employer must withhold Minne-

sota income tax from your wages.

To Get a Refund of Tax Already Withheld for the Year

File Form M1, Minnesota Individual Income Tax Return, with the Minnesota Department of Revenue. See the M1 Instructions for details.

Penalties

If you make any statements on this form that you know are incorrect, you may be assessed a $500 penalty.

Use of Information

All information on Form MWR is private by state law. It may only be given to your state of residence, the Internal Revenue Service, and to

other state tax agencies as provided by law. The information may be compared with other information you gave to the Department of Rev-

enue.

Your name, address and Social Security number are required for identification. Your address is also required to verify your state of residence.

Your employer’s name, federal tax ID number, address and phone number are required.

The only information not required is your phone number. However, we ask that you provide it so we can contact you if we have questions.

Instructions for Employers

Employees who reside in Michigan or North Dakota who ask you not to withhold Minnesota income tax from their wages must complete this

form and give it to you each year by the later of February 28 or within 30 days after they begin working for you or change their residence.

Employees who live in other states, including Minnesota, cannot use this form.

If an employee does not fill in every item of Form MWR or does not provide the form to you by the due date, you must withhold Minnesota

income tax, using the same marital status and number of allowances claimed on the employee’s federal Form W-4.

If the employee provides you with a properly completed Form MWR, the employee is not required to complete Form W-4MN to claim ex-

emption from Minnesota income tax withholding.

Submit Completed Forms MWR to the Department

By March 31 of each year, send the completed Forms MWR to Minnesota Revenue, Mail Station 6501, St. Paul, MN 55146-6501. You must

keep a copy of all forms for five years from the date received.

For new employees or employees who change their state of residence, send the form within 30 days after the employee gives it to you.

You may be assessed a $50 penalty for each form you are required to send us but do not.

Information and Assistance

Additional forms and information, including fact sheets and frequently asked questions, are available on our website.

Website:

Email: withholding.tax@state.mn.us

Phone: 651-282 9999 or 1-800-657-3594.

This information is available in alternate formats.

1

1 2

2