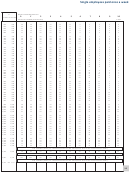

Minnesota Income Tax Withholding Instruction Booklet And Tax Tables - 2018 Page 17

ADVERTISEMENT

Married employees paid every day

If the employee’s wages

Number of withholding allowances

are

0

1

2

3

4

5

6

7

8

9

10

at least

but less than

The amount to withhold (in whole dollars)

or more

0

32

0

0

0

0

0

0

0

0

0

0

0

32

36

1

0

0

0

0

0

0

0

0

0

0

36

40

1

0

0

0

0

0

0

0

0

0

0

40

44

1

0

0

0

0

0

0

0

0

0

0

44

48

1

1

0

0

0

0

0

0

0

0

0

48

52

1

1

0

0

0

0

0

0

0

0

0

52

56

2

1

0

0

0

0

0

0

0

0

0

56

60

2

1

1

0

0

0

0

0

0

0

0

60

64

2

1

1

0

0

0

0

0

0

0

0

64

68

2

2

1

0

0

0

0

0

0

0

0

68

72

2

2

1

1

0

0

0

0

0

0

0

72

76

3

2

1

1

0

0

0

0

0

0

0

76

80

3

2

2

1

0

0

0

0

0

0

0

80

84

3

2

2

1

1

0

0

0

0

0

0

84

88

3

3

2

1

1

0

0

0

0

0

0

88

92

3

3

2

2

1

0

0

0

0

0

0

92

96

4

3

2

2

1

1

0

0

0

0

0

96

100

4

3

3

2

1

1

0

0

0

0

0

100

104

4

4

3

2

2

1

0

0

0

0

0

104

108

4

4

3

3

2

1

1

0

0

0

0

108

112

5

4

3

3

2

1

1

0

0

0

0

112

116

5

4

4

3

2

2

1

0

0

0

0

116

120

5

4

4

3

3

2

1

1

0

0

0

120

124

5

5

4

3

3

2

2

1

0

0

0

124

128

5

5

4

4

3

2

2

1

0

0

0

128

132

6

5

4

4

3

3

2

1

1

0

0

132

136

6

5

5

4

3

3

2

2

1

0

0

136

140

6

5

5

4

4

3

2

2

1

1

0

140

144

6

6

5

4

4

3

3

2

1

1

0

144

148

7

6

5

5

4

3

3

2

2

1

0

148

152

7

6

5

5

4

4

3

2

2

1

1

152

156

7

7

6

5

4

4

3

3

2

1

1

156

160

8

7

6

5

5

4

3

3

2

2

1

7.05 PERCENT (.0705) OF THE EXCESS OVER $160 PLUS (round total to the nearest whole dollar)

160

442

8

7

6

5

5

4

4

3

2

2

1

7.85 PERCENT (.0785) OF THE EXCESS OVER $442 PLUS (round total to the nearest whole dollar)

442

765

28

27

26

25

24

24

23

22

21

20

20

9.85 PERCENT (.0985) OF THE EXCESS OVER $765 PLUS (round total to the nearest whole dollar)

765 and over

53

52

51

50

49

48

48

47

46

45

44

17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34