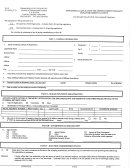

Form Esd-Ark-501 - Application For Unemployment Insurance Benefits Page 6

ADVERTISEMENT

Arkansas Department of Workforce Services - Review of Unemployment Insurance

having the 23rd highest percentage of

Based on our review, we conclude DWS

unemployment benefit overpayments during

does not match new hire and wage data in a

the three-year period at 12%.

Indiana is

timely manner. Though cross matching in-

ranked highest with a 43% error rate.

herently requires a five-month delay for data

accumulation in various databases, we noted

However, the BAM data are used by the

in 2011 that DWS was lagging two additional

USDOL as a performance measure only, and

months behind the five-month inherent lag

Arkansas is not expected to try to collect

time

when

cross

matching

procedures

estimated overpayment amounts or to repay

should have been completed.

the amount to the federal government. The

We recommend not only that DWS conduct

estimated overpayments are only used to

its cross matches of new hire and wage data

measure controls in state unemployment

in a timely manner but also that the FIRE

benefit payment processes.

Unit more proactively conduct its reviews.

DWS Calculation of Overpayments

Software programming enhancements would

allow DWS to compare new data entered by

DWS uses the annual BAM rate discussed

Arkansas employers into new hire reports

above as well as the BAM operational rate to

employers complete weekly for each newly

measure its performance. While both rates

hired employee and wage reports employers

are derived from the same data, the BAM

prepare quarterly on a continual basis rather

operational

overpayment

rate

includes

than waiting five months for the federal wage

overpayments that states are reasonably

registry to be updated. The time gained by

expected to detect and recover.

running the comparison of Arkansas data

prior to the update of the federal registry

DWS’ annual BAM rate and BAM operational

might significantly reduce the number and

rate have been below 10% each year for the

amount of claim overpayments.

past 10 years. Overpayments at the end of

fiscal years 2009 through 2011 are provided

Management Response:

in Exhibit IV and are divided between

DWS agrees that running the cross matches on a

fraudulent

and

non-fraudulent

benefit

timely basis has a positive effect upon the

overpayments.

detection of unemployment insurance overpay-

ments.

DWS now runs the cross matches as

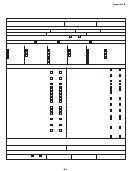

Exhibit IV

soon as is possible, given the current technologi-

Arkansas Department of Workforce Services

cal capability and given the availability of the

Recorded Overpayments (in millions)

data.

DWS

is

evaluating

processes

and

Fiscal Years 2009 through 2011

technology to determine if gains can be made in

the timing of the matches in relation to the

2011

2010

2009

payment of benefits.

Fraudulent

$31

$23

$21

Funds Advanced from

Non-Fraudulent

13

10

9

the Federal Government

Total

$44

$33

$30

Higher unemployment rates since 2009 have

caused significant increases in claims for

Source: Arkansas Department of Workforce Services

(unaudited by the Division of Legislative Audit)

unemployment benefits.

According to the

For

fiscal

year

2011,

we

identified

United States Bureau of Labor Statistics, the

overpayments to 51,580 individual claimants.

unemployment rate in Arkansas was 7.7%

Of these, 376 individuals received benefit

for calendar year 2011.

The increase in

overpayments

between

$10,000

and

claims has necessitated $360 million in loan

$50,000. One individual received overpay-

advances from the federal government over

ments

in

excess

of

$50,000,

totaling

the past three years to fund benefits

$51,046.

payments.

The loan advances bore an

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12