Schedule Nr - Form E-1 - Important Information

ADVERTISEMENT

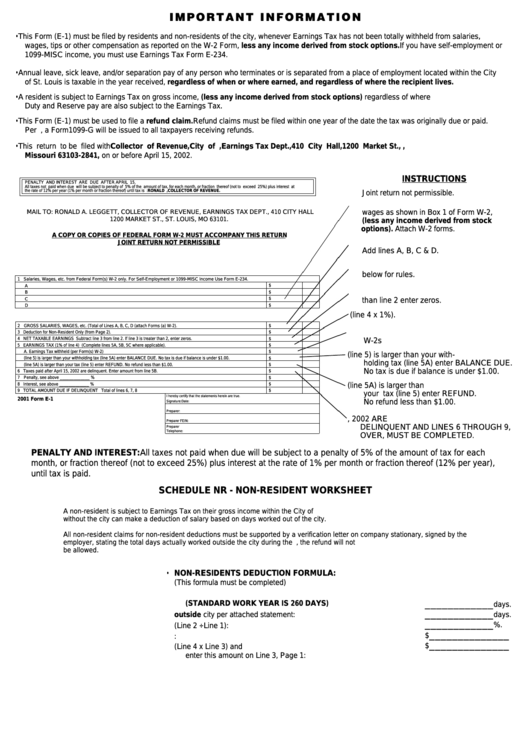

I M P O R TA N T I N F O R M AT I O N

• This Form (E-1) must be filed by residents and non-residents of the city, whenever Earnings Tax has not been totally withheld from salaries,

wages, tips or other compensation as reported on the W-2 Form, less any income derived from stock options. If you have self-employment or

1099-MISC income, you must use Earnings Tax Form E-234.

• Annual leave, sick leave, and/or separation pay of any person who terminates or is separated from a place of employment located within the City

of St. Louis is taxable in the year received, regardless of when or where earned, and regardless of where the recipient lives.

• A resident is subject to Earnings Tax on gross income, (less any income derived from stock options) regardless of where earned. Military Active

Duty and Reserve pay are also subject to the Earnings Tax.

• This Form (E-1) must be used to file a refund claim. Refund claims must be filed within one year of the date the tax was originally due or paid.

Per I.R.S. Regulations, a Form1099-G will be issued to all taxpayers receiving refunds.

• This return to be filed with Collector of Revenue, City of St. Louis, Earnings Tax Dept., 410 City Hall, 1200 Market St., St. Louis,

Missouri 63103-2841, on or before April 15, 2002.

INSTRUCTIONS

PENALTY AND INTEREST ARE DUE AFTER APRIL 15, 2002. TAX MUST BE PAID WHEN RETURN IS FILED. NO EXTENSIONS ALLOWED.

All taxes not paid when due will be subject to penalty of 5% of the amount of tax, for each month, or fraction thereof (not to exceed 25%) plus interest at

the rate of 12% per year (1% per month or fraction thereof) until tax is paid. Make payment payable to: RONALD A. LEGGETT, COLLECTOR OF REVENUE.

Joint return not permissible.

1. List W-2 Forms received. Enter total gross

wages as shown in Box 1 of Form W-2,

MAIL TO: RONALD A. LEGGETT, COLLECTOR OF REVENUE, EARNINGS TAX DEPT., 410 CITY HALL

1200 MARKET ST., ST. LOUIS, MO 63101.

(less any income derived from stock

options). Attach W-2 forms.

A COPY OR COPIES OF FEDERAL FORM W-2 MUST ACCOMPANY THIS RETURN

JOINT RETURN NOT PERMISSIBLE

2. Total gross wages of all W-2 Forms received.

Add lines A, B, C & D.

3. Non resident deduction. See Schedule NR

below for rules.

1 Salaries, Wages, etc. from Federal Form(s) W-2 only. For Self-Employment or 1099-MISC Income Use Form E-234.

$

A

4. Subtract line 3 from line 2. If line 3 is greater

$

B

$

C

than line 2 enter zeros.

D

$

5.

Earnings tax (line 4 x 1%).

2 GROSS SALARIES, WAGES, etc. (Total of Lines A, B, C, D (attach Forms (a) W-2).

$

5A. Total St. Louis earnings tax withheld on all

3 Deduction for Non-Resident Only (from Page 2).

$

4 NET TAXABLE EARNINGS Subtract line 3 from line 2. If line 3 is treater than 2, enter zeros.

$

W-2s

5 EARNINGS TAX (1% of line 4) (Complete lines 5A, 5B, 5C where applicable).

$

A. Earnings Tax withheld (per Form(s) W-2)

$

5B. If your tax (line 5) is larger than your with-

B. If your tax (line 5) is larger than your withholding tax (line 5A) enter BALANCE DUE. No tax is due if balance is under $1.00.

$

holding tax (line 5A) enter BALANCE DUE.

C. If your withholding tax (line 5A) is larger than your tax (line 5) enter REFUND. No refund less than $1.00.

$

No tax is due if balance is under $1.00.

6 Taxes paid after April 15, 2002 are delinquent. Enter amount from line 5B.

$

7 Penalty, see above _____________ %

$

8 Interest, see above _____________ %

$

5C. If your withholding tax (line 5A) is larger than

9 TOTAL AMOUNT DUE IF DELINQUENT Total of lines 6, 7, 8

$

your tax (line 5) enter REFUND.

I hereby certify that the statements herein are true.

2001 Form E-1

No refund less than $1.00.

Signature:

Date:

Preparer:

6. TAXES PAID AFTER APRIL 15, 2002 ARE

Preparer FEIN:

DELINQUENT AND LINES 6 THROUGH 9,

Preparer

Telephone:

OVER, MUST BE COMPLETED.

PENALTY AND INTEREST: All taxes not paid when due will be subject to a penalty of 5% of the amount of tax for each

month, or fraction thereof (not to exceed 25%) plus interest at the rate of 1% per month or fraction thereof (12% per year),

until tax is paid.

SCHEDULE NR - NON-RESIDENT WORKSHEET

A non-resident is subject to Earnings Tax on their gross income within the City of St. Louis. Non-residents who work both within and

without the city can make a deduction of salary based on days worked out of the city.

All non-resident claims for non-resident deductions must be supported by a verification letter on company stationary, signed by the

employer, stating the total days actually worked outside the city during the year. Without this letter and copy of W-2, the refund will not

be allowed.

NON-RESIDENTS DEDUCTION FORMULA:

•

(This formula must be completed)

1. Actual days worked-everywhere

____________

(STANDARD WORK YEAR IS 260 DAYS)

days.

____________

2. Actual days worked outside city per attached statement:

days.

____________

%.

3. Percentage of days worked outside city (Line 2 ÷ Line 1):

______________

$

4. Gross wage per Federal W-2 Form:

______________

$

5. Deductible wages (Line 4 x Line 3) and

enter this amount on Line 3, Page 1:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1