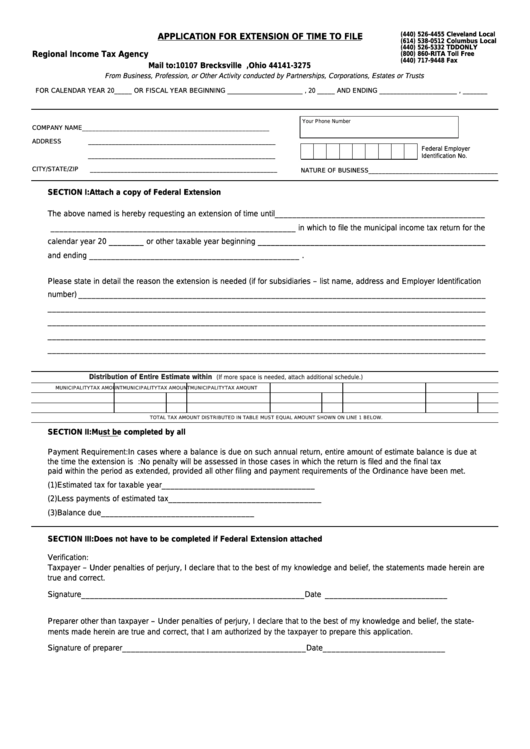

Form Application For Extension Of Time To File

ADVERTISEMENT

(440) 526-4455 Cleveland Local

APPLICATION FOR EXTENSION OF TIME TO FILE

(614) 538-0512 Columbus Local

(440) 526-5332 TDD ONLY

Regional Income Tax Agency

(800) 860-RITA Toll Free

(440) 717-9448 Fax

Mail to:

10107 Brecksville Rd.

Brecksville, Ohio 44141-3275

From Business, Profession, or Other Activity conducted by Partnerships, Corporations, Estates or Trusts

FOR CALENDAR YEAR 20_____ OR FISCAL YEAR BEGINNING ______________________ , 20 _____ AND ENDING ______________________ , _______

Your Phone Number

COMPANY NAME

_______________________________________________________

ADDRESS

_______________________________________________________

Federal Employer

_______________________________________________________

Identification No.

CITY/STATE/ZIP

_______________________________________________________

NATURE OF BUSINESS ______________________________________

SECTION I:

Attach a copy of Federal Extension

The above named is hereby requesting an extension of time until________________________________________________

________________________________________________________ in which to file the municipal income tax return for the

calendar year 20 ________ or other taxable year beginning ____________________________________________________

and ending ________________________________________________ .

Please state in detail the reason the extension is needed (if for subsidiaries – list name, address and Employer Identification

number) _____________________________________________________________________________________________

____________________________________________________________________________________________________

____________________________________________________________________________________________________

____________________________________________________________________________________________________

____________________________________________________________________________________________________

Distribution of Entire Estimate within R.I.T.A. MUNICIPALITIES

(If more space is needed, attach additional schedule.)

MUNICIPALITY

TAX AMOUNT

MUNICIPALITY

TAX AMOUNT

MUNICIPALITY

TAX AMOUNT

TOTAL TAX AMOUNT DISTRIBUTED IN TABLE MUST EQUAL AMOUNT SHOWN ON LINE 1 BELOW.

SECTION II:

Must be completed by all

Payment Requirement: In cases where a balance is due on such annual return, entire amount of estimate balance is due at

the time the extension is filed. Note: No penalty will be assessed in those cases in which the return is filed and the final tax

paid within the period as extended, provided all other filing and payment requirements of the Ordinance have been met.

(1) Estimated tax for taxable year

___________________________________

(2) Less payments of estimated tax

___________________________________

(3) Balance due

___________________________________

SECTION III:

Does not have to be completed if Federal Extension attached

Verification:

Taxpayer – Under penalties of perjury, I declare that to the best of my knowledge and belief, the statements made herein are

true and correct.

Signature ___________________________________________________

Date ____________________________

Preparer other than taxpayer – Under penalties of perjury, I declare that to the best of my knowledge and belief, the state-

ments made herein are true and correct, that I am authorized by the taxpayer to prepare this application.

Signature of preparer __________________________________________

Date ____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1