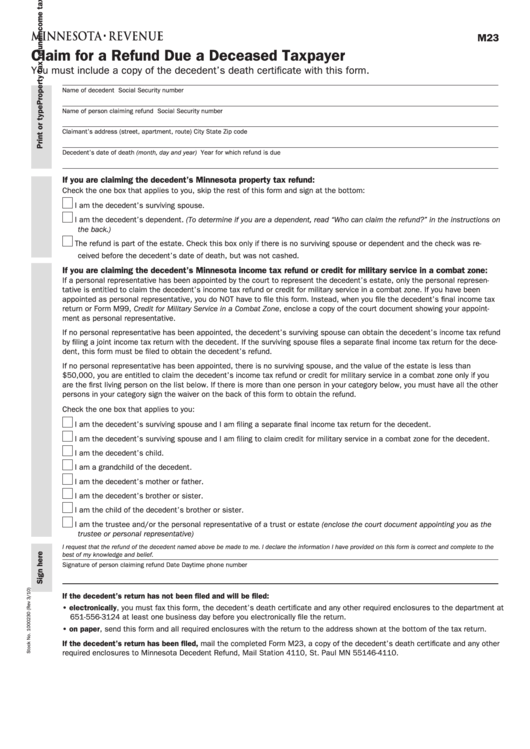

M23

Claim for a Refund Due a Deceased Taxpayer

You must include a copy of the decedent’s death certificate with this form.

Name of decedent

Social Security number

Name of person claiming refund

Social Security number

Claimant’s address (street, apartment, route)

City

State

Zip code

Decedent’s date of death (month, day and year)

Year for which refund is due

If you are claiming the decedent’s Minnesota property tax refund:

Check the one box that applies to you, skip the rest of this form and sign at the bottom:

I am the decedent’s surviving spouse.

I am the decedent’s dependent. (To determine if you are a dependent, read “Who can claim the refund?” in the instructions on

the back.)

The refund is part of the estate. Check this box only if there is no surviving spouse or dependent and the check was re-

ceived before the decedent’s date of death, but was not cashed.

If you are claiming the decedent’s Minnesota income tax refund or credit for military service in a combat zone:

If a personal representative has been appointed by the court to represent the decedent’s estate, only the personal represen-

tative is entitled to claim the decedent’s income tax refund or credit for military service in a combat zone. If you have been

appointed as personal representative, you do NOT have to file this form. Instead, when you file the decedent’s final income tax

return or Form M99, Credit for Military Service in a Combat Zone, enclose a copy of the court document showing your appoint-

ment as personal representative.

If no personal representative has been appointed, the decedent’s surviving spouse can obtain the decedent’s income tax refund

by filing a joint income tax return with the decedent. If the surviving spouse files a separate final income tax return for the dece-

dent, this form must be filed to obtain the decedent’s refund.

If no personal representative has been appointed, there is no surviving spouse, and the value of the estate is less than

$50,000, you are entitled to claim the decedent’s income tax refund or credit for military service in a combat zone only if you

are the first living person on the list below. If there is more than one person in your category below, you must have all the other

persons in your category sign the waiver on the back of this form to obtain the refund.

Check the one box that applies to you:

I am the decedent’s surviving spouse and I am filing a separate final income tax return for the decedent.

I am the decedent’s surviving spouse and I am filing to claim credit for military service in a combat zone for the decedent.

I am the decedent’s child.

I am a grandchild of the decedent.

I am the decedent’s mother or father.

I am the decedent’s brother or sister.

I am the child of the decedent’s brother or sister.

I am the trustee and/or the personal representative of a trust or estate (enclose the court document appointing you as the

trustee or personal representative)

I request that the refund of the decedent named above be made to me. I declare the information I have provided on this form is correct and complete to the

best of my knowledge and belief.

Signature of person claiming refund

Date

Daytime phone number

If the decedent’s return has not been filed and will be filed:

• electronically, you must fax this form, the decedent’s death certificate and any other required enclosures to the department at

651-556-3124 at least one business day before you electronically file the return.

• on paper, send this form and all required enclosures with the return to the address shown at the bottom of the tax return.

If the decedent’s return has been filed, mail the completed Form M23, a copy of the decedent’s death certificate and any other

required enclosures to Minnesota Decedent Refund, Mail Station 4110, St. Paul MN 55146-4110.

1

1 2

2