Form Pv56 - Ubit Return Payment

Download a blank fillable Form Pv56 - Ubit Return Payment in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Pv56 - Ubit Return Payment with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

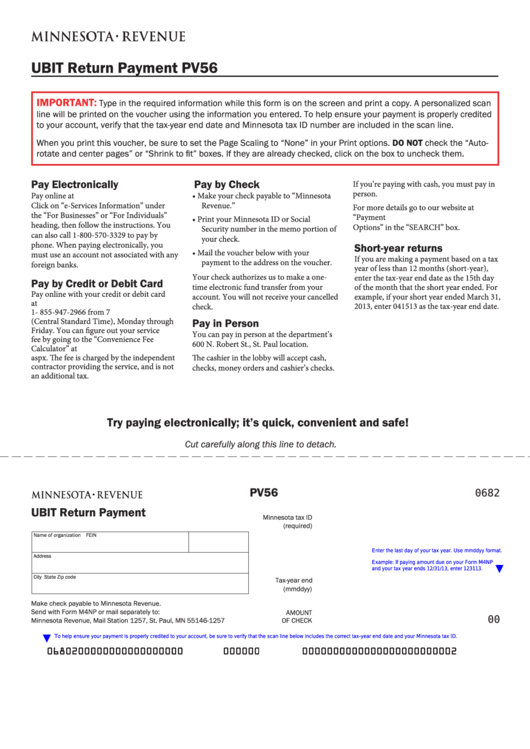

UBIT Return Payment

PV56

IMPORTANT:

Type in the required information while this form is on the screen and print a copy. A personalized scan

line will be printed on the voucher using the information you entered. To help ensure your payment is properly credited

to your account, verify that the tax-year end date and Minnesota tax ID number are included in the scan line.

When you print this voucher, be sure to set the Page Scaling to “None” in your Print options. DO NOT check the “Auto-

rotate and center pages” or “Shrink to fit” boxes. If they are already checked, click on the box to uncheck them.

Pay Electronically

Pay by Check

If you’re paying with cash, you must pay in

person.

Pay online at

• Make your check payable to “Minnesota

Click on “e-Services Information” under

Revenue. ”

For more details go to our website at www.

the “For Businesses” or “For Individuals”

revenue.state.mn.us and type “Payment

• Print your Minnesota ID or Social

heading, then follow the instructions. You

Options” in the “SEARCH” box.

Security number in the memo portion of

can also call 1-800-570-3329 to pay by

your check.

phone. When paying electronically, you

Short-year returns

• Mail the voucher below with your

must use an account not associated with any

If you are making a payment based on a tax

payment to the address on the voucher.

foreign banks.

year of less than 12 months (short-year),

Your check authorizes us to make a one-

enter the tax-year end date as the 15th day

Pay by Credit or Debit Card

time electronic fund transfer from your

of the month that the short year ended. For

Pay online with your credit or debit card

account. You will not receive your cancelled

example, if your short year ended March 31,

at You can also call

check.

2013, enter 041513 as the tax-year end date.

1- 855-947-2966 from 7 a.m. to 7 p.m.

(Central Standard Time), Monday through

Pay in Person

Friday. You can figure out your service

You can pay in person at the department’s

fee by going to the “Convenience Fee

600 N. Robert St., St. Paul location.

Calculator” at

aspx. The fee is charged by the independent

The cashier in the lobby will accept cash,

contractor providing the service, and is not

checks, money orders and cashier’s checks.

an additional tax.

Try paying electronically; it’s quick, convenient and safe!

Cut carefully along this line to detach.

PV56

0682

UBIT Return Payment

Minnesota tax ID

(required)

Name of organization

FEIN

Enter the last day of your tax year. Use mmddyy format.

Address

Example: If paying amount due on your Form M4NP

and your tax year ends 12/31/13, enter 123113.

City

State

Zip code

Tax-year end

(mmddyy)

Make check payable to Minnesota Revenue.

Send with Form M4NP or mail separately to:

AMOUNT

Minnesota Revenue, Mail Station 1257, St. Paul, MN 55146-1257

OF CHECK

00

To help ensure your payment is properly credited to your account, be sure to verify that the scan line below includes the correct tax-year end date and your Minnesota tax ID.

0000000000000000000000002

0680200000000000000000123110000000

000000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1