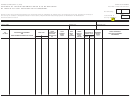

Form Boe-600-R - Schedule Of Leased Equipment With Fixed Location To Be Assessed By The Board Of Equalization To The Lessee (Railroad) Page 2

ADVERTISEMENT

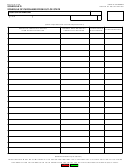

BOE-600-R (BACK) REV. 8 (12-05)

INSTRUCTIONS

All leased or rented equipment (personal property or fixtures) in the possession of the assessee must be reported.

The cost of Capitalized leased property should also be reported in the same manner as owned property, using BOE-517 schedules.

Noncapitalized leased or rented rolling stock, roadway machines and equipment without fixed location must be reported on the separate Statement of Leased

Rolling Stock. (See publication 67-RR, Instructions for Reporting State-Assessed Property, Part IIE.)

For all other rented or leased equipment not capitalized (such as operating leases), if you (the lessee) are obligated to pay the property taxes or there is no written

understanding that the lessor is obligated to pay the property taxes, report the equipment on BOE-600-R. If the lessor is obligated by Written Terms of the lease to

pay the property taxes, report the equipment on BOE-600-B unless other specific instructions require the equipment to be reported elsewhere.

Property leased from an entity described in Revenue and Taxation Code section 235 (financial corporation) must be reported on BOE-600-R notwithstanding the

terms of the lease with respect to payment of the property taxes. Property that is industry specific (e.g., locomotives, freight cars, etc.) must also be reported on

BOE-600-R, notwithstanding the terms of the lease or written understanding between state assessee and lessor. This property will be assessed to the State Board

of Equalization assessee.

Enter the assessee’s name as shown on BOE-517, the three- or four-digit SBE number, lien date year, and the county name and number.

If there is no equipment to be reported on this form, either return this form marked “NONE” in the “Description of Equipment and Name and Address of Lessor” column or

mark the “N/A” box on the front of BOE-517, indicating nothing to be reported.

If there is equipment to be reported, a separate schedule must be filed for each California county in which the equipment is located. Make copies of this form as needed.

All property reported on this form must also be reported on the BOE-533-E, Tangible Property List.

For each separate lease:

Column A

Enter the number of units.

Column B

Enter a brief description of the equipment and the name and mailing address of the lessor.

Column C

Indicate lease type as either “Capital” or “Operating.”

Column D

Enter the lease contract number or other lease identification number.

Column E

Enter the original retail price of the equipment including the original price, freight-in, sales or use tax, installation, and all other costs required to place the

equipment in service. If the original price is unknown, enter the cost data known to you and specify the basis of the data.

Column F

Enter the date manufactured. If this date is not known, enter the date you first acquired the equipment, and if the equipment was not new when you

acquired it, enter “used” under the date.

Column G

Enter the gross monthly rental/lease amount.

Column H

Indicate who (you or the lessor) is responsible for maintenance of the equipment. (If responsibility for maintenance is with the lessor, and if the amount

for maintenance is separately stated in the lease agreement, provide details on an attachment.)

Column I

Enter the remaining term of the lease (number of months). If the lease is open ended or indefinite, indicate by entering “O.E.” or “Ind.”

Column J

Enter the complete address (include street and city) where the equipment is located.

Column K

Enter the tax rate area where the equipment is located.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2