PDFControls.NET 2.0 PRO

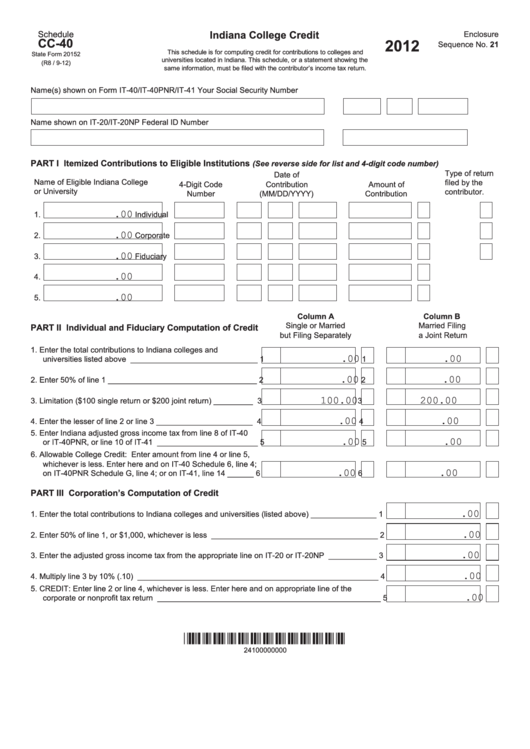

Indiana College Credit

Schedule

Enclosure

CC-40

2012

Sequence No. 21

This schedule is for computing credit for contributions to colleges and

State Form 20152

universities located in Indiana. This schedule, or a statement showing the

(R8 / 9-12)

same information, must be filed with the contributor’s income tax return.

Name(s) shown on Form IT-40/IT-40PNR/IT-41

Your Social Security Number

Name shown on IT-20/IT-20NP

Federal ID Number

PART I Itemized Contributions to Eligible Institutions

(See reverse side for list and 4-digit code number)

Type of return

Date of

Name of Eligible Indiana College

filed by the

4-Digit Code

Contribution

Amount of

or University

contributor.

Number

(MM/DD/YYYY)

Contribution

.00

1.

Individual

.00

2.

Corporate

.00

3.

Fiduciary

.00

4.

.00

5.

Column A

Column B

Single or Married

Married Filing

PART II Individual and Fiduciary Computation of Credit

but Filing Separately

a Joint Return

1. Enter the total contributions to Indiana colleges and

.00

.00

universities listed above _____________________________

1

1

.00

.00

2. Enter 50% of line 1 __________________________________

2

2

100.00

200.00

3. Limitation ($100 single return or $200 joint return) _________

3

3

.00

.00

4. Enter the lesser of line 2 or line 3 ______________________

4

4

5. Enter Indiana adjusted gross income tax from line 8 of IT-40

.00

.00

or IT-40PNR, or line 10 of IT-41 _______________________

5

5

6. Allowable College Credit: Enter amount from line 4 or line 5,

whichever is less. Enter here and on IT-40 Schedule 6, line 4;

.00

.00

on IT-40PNR Schedule G, line 4; or on IT-41, line 14 ______

6

6

PART III Corporation’s Computation of Credit

.00

1. Enter the total contributions to Indiana colleges and universities (listed above) _______________

1

.00

2. Enter 50% of line 1, or $1,000, whichever is less ______________________________________

2

.00

3. Enter the adjusted gross income tax from the appropriate line on IT-20 or IT-20NP ___________

3

.00

4. Multiply line 3 by 10% (.10) _______________________________________________________

4

5. CREDIT: Enter line 2 or line 4, whichever is less. Enter here and on appropriate line of the

.00

corporate or nonprofit tax return ___________________________________________________

5

*24100000000*

24100000000

1

1 2

2