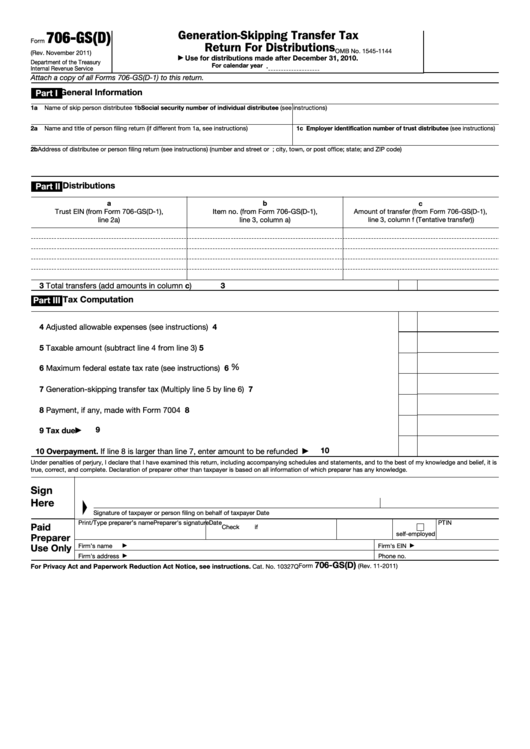

706-GS(D)

Generation-Skipping Transfer Tax

Form

Return For Distributions

OMB No. 1545-1144

(Rev. November 2011)

Use for distributions made after December 31, 2010.

▶

Department of the Treasury

For calendar year

.

Internal Revenue Service

Attach a copy of all Forms 706-GS(D-1) to this return.

General Information

Part I

1a

Name of skip person distributee

1b

Social security number of individual distributee (see instructions)

2a

Name and title of person filing return (if different from 1a, see instructions)

1c

Employer identification number of trust distributee (see instructions)

2b

Address of distributee or person filing return (see instructions) (number and street or P.O. box; city, town, or post office; state; and ZIP code)

Distributions

Part II

a

b

c

Trust EIN (from Form 706-GS(D-1),

Item no. (from Form 706-GS(D-1),

Amount of transfer (from Form 706-GS(D-1),

line 2a)

line 3, column a)

line 3, column f (Tentative transfer))

3

Total transfers (add amounts in column c ) .

3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Tax Computation

Part III

4

4

Adjusted allowable expenses (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Taxable amount (subtract line 4 from line 3) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

%

6

Maximum federal estate tax rate (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

7

7

Generation-skipping transfer tax (Multiply line 5 by line 6) .

.

.

.

.

.

.

.

.

.

.

.

.

8

Payment, if any, made with Form 7004 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9

9

Tax due .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

10

10

Overpayment. If line 8 is larger than line 7, enter amount to be refunded .

.

.

.

.

.

.

▶

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is

true, correct, and complete. Declaration of preparer other than taxpayer is based on all information of which preparer has any knowledge.

Sign

Here

Signature of taxpayer or person filing on behalf of taxpayer

Date

Print/Type preparer’s name

Preparer's signature

Date

PTIN

Paid

Check

if

self-employed

Preparer

Use Only

Firm’s name

Firm's EIN

▶

▶

Firm's address

Phone no.

▶

706-GS(D)

Form

(Rev. 11-2011)

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 10327Q

1

1