Click Here to Print Document

CLICK HERE TO CLEAR FORM

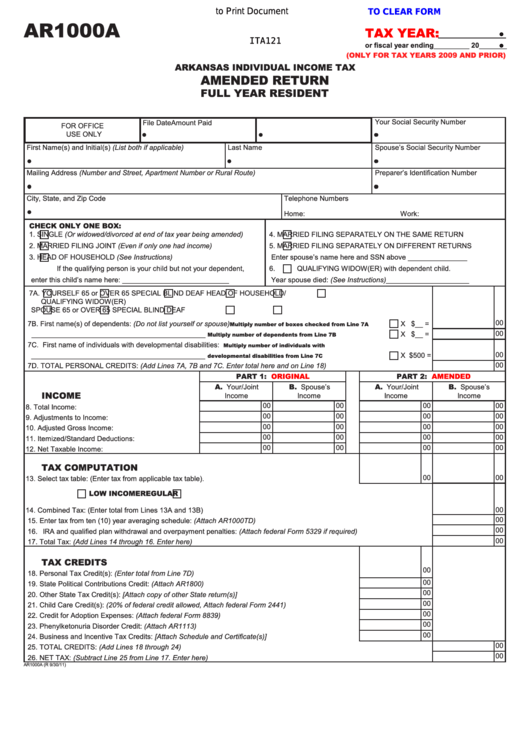

AR1000A

TAX YEAR:

ITA121

or fiscal year ending_________ 20_______

(ONLY FOR TAX YEARS 2009 AND PRIOR)

ARKANSAS INDIVIDUAL INCOME TAX

AMENDED RETURN

FULL YEAR RESIDENT

Your Social Security Number

File Date

Amount Paid

FOR OFFICE

USE ONLY

First Name(s) and Initial(s) (List both if applicable)

Last Name

Spouse’s Social Security Number

Mailing Address (Number and Street, Apartment Number or Rural Route)

Preparer’s Identification Number

City, State, and Zip Code

Telephone Numbers

Home:

Work:

CHECK ONLY ONE BOX:

1.

SINGLE (Or widowed/divorced at end of tax year being amended)

4.

MARRIED FILING SEPARATELY ON THE SAME RETURN

2.

MARRIED FILING JOINT (Even if only one had income)

5.

MARRIED FILING SEPARATELY ON DIFFERENT RETURNS

3.

HEAD OF HOUSEHOLD (See Instructions)

Enter spouse’s name here and SSN above _______________

If the qualifying person is your child but not your dependent,

6.

QUALIFYING WIDOW(ER) with dependent child.

enter this child’s name here: ___________________________

Year spouse died: (See Instructions)_____________________

7A.

YOURSELF

65 or OVER

65 SPECIAL

BLIND

DEAF

HEAD OF HOUSEHOLD/

QUALIFYING WIDOW(ER)

SPOUSE

65 or OVER

65 SPECIAL

BLIND

DEAF

00

7B. First name(s) of dependents: (Do not list yourself or spouse)

....

X $__ =

Multiply number of boxes checked from Line 7A

00

____________________________________________

.........

X $__ =

Multiply number of dependents from Line 7B

7C. First name of individuals with developmental disabilities:

Multiply number of individuals with

00

____________________________________________

................

X $500 =

developmental disabilities from Line 7C

00

7D. TOTAL PERSONAL CREDITS: (Add Lines 7A, 7B and 7C. Enter total here and on Line 18) ................................................. 7D

PART 1:

ORIGINAL

PART 2:

AMENDED

A. Your/Joint

B. Spouse’s

A. Your/Joint

B. Spouse’s

INCOME

Income

Income

Income

Income

00

00

00

00

8. Total Income: ........................................................8

8

00

00

00

00

9. Adjustments to Income: ........................................9

9

00

00

00

00

10. Adjusted Gross Income: .....................................10

10

00

00

00

00

11. Itemized/Standard Deductions: .......................... 11

11

00

00

00

00

12. Net Taxable Income: ...........................................12

12

TAX COMPUTATION

00

00

13. Select tax table: (Enter tax from applicable tax table). .........................................................................13

LOW INCOME

REGULAR

14. Combined Tax: (Enter total from Lines 13A and 13B) ...............................................................................................................14

00

00

15. Enter tax from ten (10) year averaging schedule: (Attach AR1000TD) .....................................................................................15

00

16. IRA and qualified plan withdrawal and overpayment penalties: (Attach federal Form 5329 if required) ................................... 16

00

17. Total Tax: (Add Lines 14 through 16. Enter here) ......................................................................................................................17

TAX CREDITS

00

18. Personal Tax Credit(s): (Enter total from Line 7D) ...............................................................................18

00

19. State Political Contributions Credit: (Attach AR1800) ..........................................................................19

00

20. Other State Tax Credit(s): [Attach copy of other State return(s)] ..........................................................20

00

21. Child Care Credit(s): (20% of federal credit allowed, Attach federal Form 2441) .................................21

00

22. Credit for Adoption Expenses: (Attach federal Form 8839) ..................................................................22

00

23. Phenylketonuria Disorder Credit: (Attach AR1113) ..............................................................................23

00

24. Business and Incentive Tax Credits: [Attach Schedule and Certificate(s)] ...........................................24

00

25. TOTAL CREDITS: (Add Lines 18 through 24) ...........................................................................................................................25

00

26. NET TAX: (Subtract Line 25 from Line 17. Enter here) .............................................................................................................26

AR1000A (R 9/30/11)

1

1 2

2