M

B

a

Ph: 651-296-7938

innesota

oard of

ccountancy

Fax: 651-282-2644

85 East 7th Place, Suite 125

boa.state.mn.us

St. Paul, MN 55101-2143

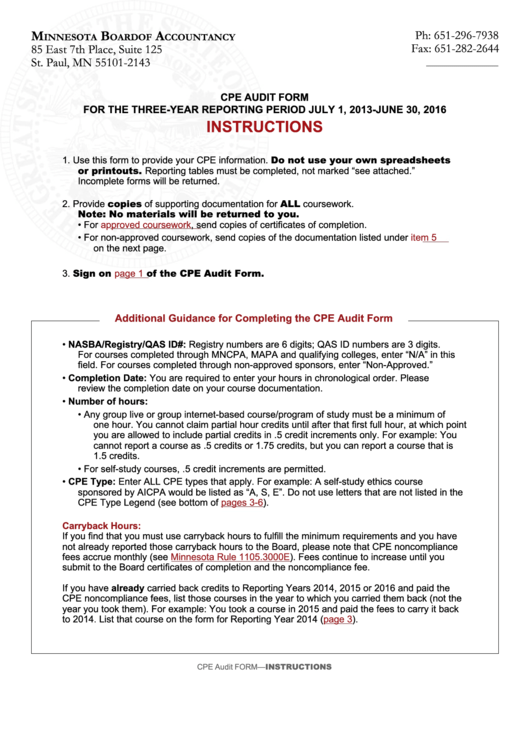

CPE AUDIT FORM

FOR THE THREE-YEAR REPORTING PERIOD JULY 1, 2013-JUNE 30, 2016

INSTRUCTIONS

1. Use this form to provide your CPE information. Do not use your own spreadsheets

or printouts. Reporting tables must be completed, not marked “see attached.”

Incomplete forms will be returned.

2. Provide copies of supporting documentation for ALL coursework.

Note: No materials will be returned to you.

•

For

approved

coursework, send copies of certificates of completion.

•

For non-approved coursework, send copies of the documentation listed under

item 5

on the next page.

3. Sign on

of the CPE Audit Form.

page 1

Additional Guidance for Completing the CPE Audit Form

•

NASBA/Registry/QAS ID#: Registry numbers are 6 digits; QAS ID numbers are 3 digits.

For courses completed through MNCPA, MAPA and qualifying colleges, enter “N/A” in this

field. For courses completed through non-approved sponsors, enter “Non-Approved.”

•

Completion Date: You are required to enter your hours in chronological order. Please

review the completion date on your course documentation.

•

Number of hours:

•

Any group live or group internet-based course/program of study must be a minimum of

one hour. You cannot claim partial hour credits until after that first full hour, at which point

you are allowed to include partial credits in .5 credit increments only. For example: You

cannot report a course as .5 credits or 1.75 credits, but you can report a course that is

1.5 credits.

•

For self-study courses, .5 credit increments are permitted.

•

CPE Type: Enter ALL CPE types that apply. For example: A self-study ethics course

sponsored by AICPA would be listed as “A, S, E”. Do not use letters that are not listed in the

CPE Type Legend (see bottom of

pages

3-6).

Carryback Hours:

If you find that you must use carryback hours to fulfill the minimum requirements and you have

not already reported those carryback hours to the Board, please note that CPE noncompliance

fees accrue monthly (see

Minnesota Rule

1105.3000E). Fees continue to increase until you

submit to the Board certificates of completion and the noncompliance fee.

If you have already carried back credits to Reporting Years 2014, 2015 or 2016 and paid the

CPE noncompliance fees, list those courses in the year to which you carried them back (not the

year you took them). For example: You took a course in 2015 and paid the fees to carry it back

to 2014. List that course on the form for Reporting Year 2014

(page

3).

CPE Audit FORM—INSTRUCTIONS

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8