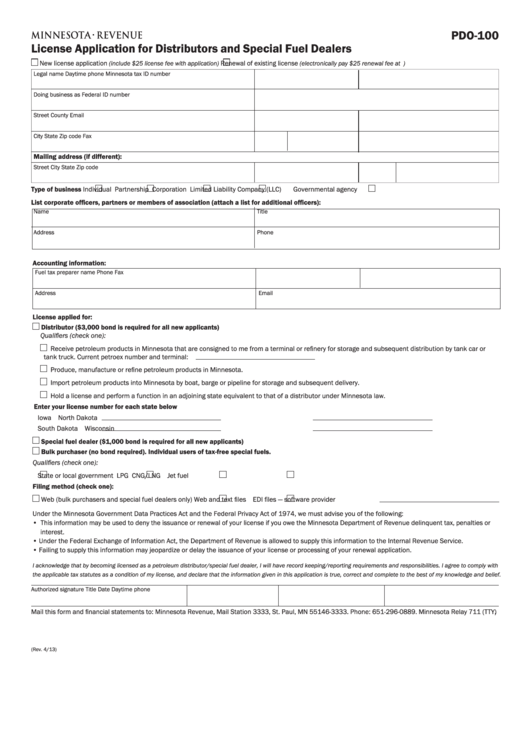

PDO-100

License Application for Distributors and Special Fuel Dealers

New license application

Renewal of existing license

(include $25 license fee with application)

(electronically pay $25 renewal fee at )

Legal name

Daytime phone

Minnesota tax ID number

Doing business as

Federal ID number

Street

County

Email

City

State

Zip code

Fax

Mailing address (if different):

Street

City

State

Zip code

Type of business

Individual

Partnership

Corporation

Limited Liability Company (LLC)

Governmental agency

List corporate officers, partners or members of association (attach a list for additional officers):

Name

Title

Address

Phone

Accounting information:

Fuel tax preparer name

Phone

Fax

Address

Email

License applied for:

Distributor ($3,000 bond is required for all new applicants)

Qualifiers (check one):

Receive petroleum products in Minnesota that are consigned to me from a terminal or refinery for storage and subsequent distribution by tank car or

tank truck. Current petroex number and terminal:

Produce, manufacture or refine petroleum products in Minnesota.

Import petroleum products into Minnesota by boat, barge or pipeline for storage and subsequent delivery.

Hold a license and perform a function in an adjoining state equivalent to that of a distributor under Minnesota law.

Enter your license number for each state below

Iowa

North Dakota

South Dakota

Wisconsin

Special fuel dealer ($1,000 bond is required for all new applicants)

Bulk purchaser (no bond required). Individual users of tax-free special fuels.

Qualifiers (check one):

State or local government

LPG

CNG/LNG

Jet fuel

Filing method (check one):

Web (bulk purchasers and special fuel dealers only)

Web and text files

EDI files — software provider

Under the Minnesota Government Data Practices Act and the Federal Privacy Act of 1974, we must advise you of the following:

• This information may be used to deny the issuance or renewal of your license if you owe the Minnesota Department of Revenue delinquent tax, penalties or

interest.

• Under the Federal Exchange of Information Act, the Department of Revenue is allowed to supply this information to the Internal Revenue Service.

• Failing to supply this information may jeopardize or delay the issuance of your license or processing of your renewal application.

I acknowledge that by becoming licensed as a petroleum distributor/special fuel dealer, I will have record keeping/reporting requirements and responsibilities. I agree to comply with

the applicable tax statutes as a condition of my license, and declare that the information given in this application is true, correct and complete to the best of my knowledge and belief.

Authorized signature

Title

Date

Daytime phone

Mail this form and financial statements to: Minnesota Revenue, Mail Station 3333, St. Paul, MN 55146-3333. Phone: 651-296-0889. Minnesota Relay 711 (TTY).

(Rev. 4/13)

1

1