Non-Foreign Seller Information Sheet - Oklahoma Real Estate Commission

ADVERTISEMENT

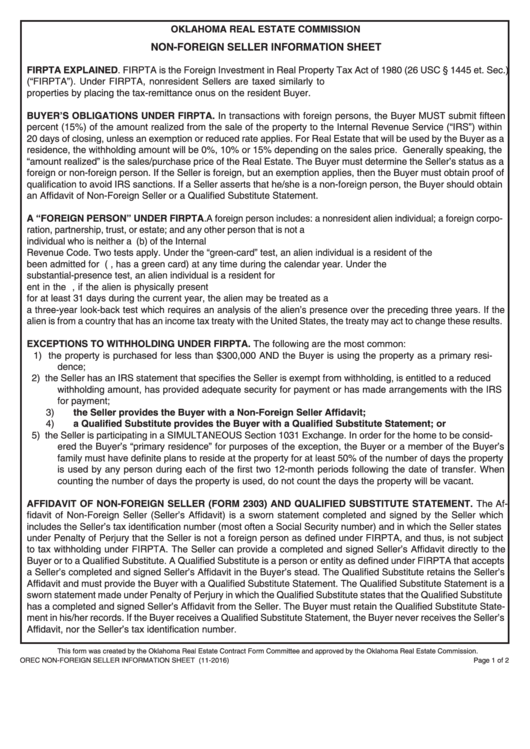

OKLAHOMA REAL ESTATE COMMISSION

NON-FOREIGN SELLER INFORMATION SHEET

FIRPTA EXPLAINED. FIRPTA is the Foreign Investment in Real Property Tax Act of 1980 (26 USC § 1445 et. Sec.)

(“FIRPTA”). Under FIRPTA, nonresident Sellers are taxed similarly to U.S. real estate owners when selling their

properties by placing the tax-remittance onus on the resident Buyer.

BUYER’S OBLIGATIONS UNDER FIRPTA. In transactions with foreign persons, the Buyer MUST submit fifteen

percent (15%) of the amount realized from the sale of the property to the Internal Revenue Service (“IRS”) within

20 days of closing, unless an exemption or reduced rate applies. For Real Estate that will be used by the Buyer as a

residence, the withholding amount will be 0%, 10% or 15% depending on the sales price. Generally speaking, the

“amount realized” is the sales/purchase price of the Real Estate. The Buyer must determine the Seller’s status as a

foreign or non-foreign person. If the Seller is foreign, but an exemption applies, then the Buyer must obtain proof of

qualification to avoid IRS sanctions. If a Seller asserts that he/she is a non-foreign person, the Buyer should obtain

an Affidavit of Non-Foreign Seller or a Qualified Substitute Statement.

A “FOREIGN PERSON” UNDER FIRPTA. A foreign person includes: a nonresident alien individual; a foreign corpo-

ration, partnership, trust, or estate; and any other person that is not a U.S. person. A nonresident alien is defined as an

individual who is neither a U.S. citizen nor a resident of the U.S. within the meaning of section 770 1 (b) of the Internal

Revenue Code. Two tests apply. Under the “green-card” test, an alien individual is a resident of the U.S. if he/she has

been admitted for U.S. permanent residence (i.e., has a green card) at any time during the calendar year. Under the

substantial-presence test, an alien individual is a resident for U.S. federal tax purposes if the alien is physically pres-

ent in the U.S. for 183 days or more during the current calendar year. Alternatively, if the alien is physically present

for at least 31 days during the current year, the alien may be treated as a U.S. tax resident in the current year under

a three-year look-back test which requires an analysis of the alien’s presence over the preceding three years. If the

alien is from a country that has an income tax treaty with the United States, the treaty may act to change these results.

EXCEPTIONS TO WITHHOLDING UNDER FIRPTA. The following are the most common:

1) the property is purchased for less than $300,000 AND the Buyer is using the property as a primary resi-

dence;

2) the Seller has an IRS statement that specifies the Seller is exempt from withholding, is entitled to a reduced

withholding amount, has provided adequate security for payment or has made arrangements with the IRS

for payment;

3) the Seller provides the Buyer with a Non-Foreign Seller Affidavit;

4) a Qualified Substitute provides the Buyer with a Qualified Substitute Statement; or

5) the Seller is participating in a SIMULTANEOUS Section 1031 Exchange. In order for the home to be consid-

ered the Buyer’s “primary residence” for purposes of the exception, the Buyer or a member of the Buyer’s

family must have definite plans to reside at the property for at least 50% of the number of days the property

is used by any person during each of the first two 12-month periods following the date of transfer. When

counting the number of days the property is used, do not count the days the property will be vacant.

AFFIDAVIT OF NON-FOREIGN SELLER (FORM 2303) AND QUALIFIED SUBSTITUTE STATEMENT. The Af-

fidavit of Non-Foreign Seller (Seller’s Affidavit) is a sworn statement completed and signed by the Seller which

includes the Seller’s tax identification number (most often a Social Security number) and in which the Seller states

under Penalty of Perjury that the Seller is not a foreign person as defined under FIRPTA, and thus, is not subject

to tax withholding under FIRPTA. The Seller can provide a completed and signed Seller’s Affidavit directly to the

Buyer or to a Qualified Substitute. A Qualified Substitute is a person or entity as defined under FIRPTA that accepts

a Seller’s completed and signed Seller’s Affidavit in the Buyer’s stead. The Qualified Substitute retains the Seller’s

Affidavit and must provide the Buyer with a Qualified Substitute Statement. The Qualified Substitute Statement is a

sworn statement made under Penalty of Perjury in which the Qualified Substitute states that the Qualified Substitute

has a completed and signed Seller’s Affidavit from the Seller. The Buyer must retain the Qualified Substitute State-

ment in his/her records. If the Buyer receives a Qualified Substitute Statement, the Buyer never receives the Seller’s

Affidavit, nor the Seller’s tax identification number.

This form was created by the Oklahoma Real Estate Contract Form Committee and approved by the Oklahoma Real Estate Commission.

OREC NON-FOREIGN SELLER INFORMATION SHEET (11-2016)

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2