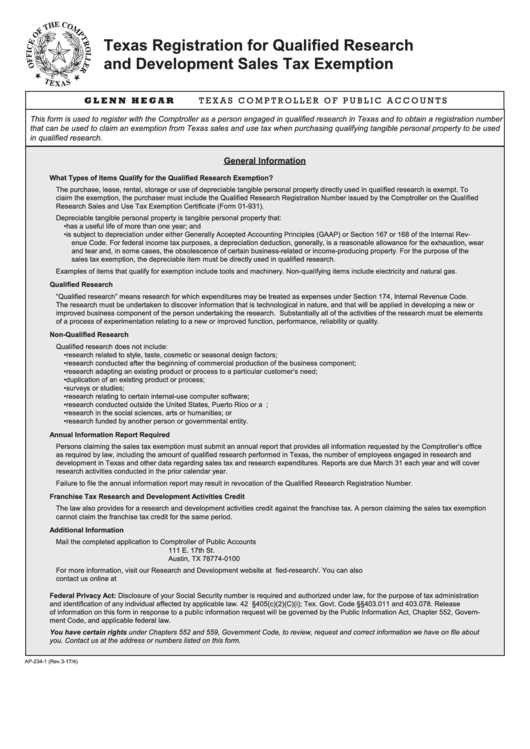

Texas Registration for Qualified Research

and Development Sales Tax Exemption

G L E N N H E G A R

T E X A S C O M P T R O L L E R O F P U B L I C A C C O U N T S

This form is used to register with the Comptroller as a person engaged in qualified research in Texas and to obtain a registration number

that can be used to claim an exemption from Texas sales and use tax when purchasing qualifying tangible personal property to be used

in qualified research.

General Information

What Types of Items Qualify for the Qualified Research Exemption?

The purchase, lease, rental, storage or use of depreciable tangible personal property directly used in qualified research is exempt. To

claim the exemption, the purchaser must include the Qualified Research Registration Number issued by the Comptroller on the Qualified

Research Sales and Use Tax Exemption Certificate (Form 01-931).

Depreciable tangible personal property is tangible personal property that:

• has a useful life of more than one year; and

• is subject to depreciation under either Generally Accepted Accounting Principles (GAAP) or Section 167 or 168 of the Internal Rev-

enue Code. For federal income tax purposes, a depreciation deduction, generally, is a reasonable allowance for the exhaustion, wear

and tear and, in some cases, the obsolescence of certain business-related or income-producing property. For the purpose of the

sales tax exemption, the depreciable item must be directly used in qualified research.

Examples of items that qualify for exemption include tools and machinery. Non-qualifying items include electricity and natural gas.

Qualified Research

“Qualified research” means research for which expenditures may be treated as expenses under Section 174, Internal Revenue Code.

The research must be undertaken to discover information that is technological in nature, and that will be applied in developing a new or

improved business component of the person undertaking the research. Substantially all of the activities of the research must be elements

of a process of experimentation relating to a new or improved function, performance, reliability or quality.

Non-Qualified Research

Qualified research does not include:

• research related to style, taste, cosmetic or seasonal design factors;

• research conducted after the beginning of commercial production of the business component;

• research adapting an existing product or process to a particular customer’s need;

• duplication of an existing product or process;

• surveys or studies;

• research relating to certain internal-use computer software;

• research conducted outside the United States, Puerto Rico or a U.S. possession;

• research in the social sciences, arts or humanities; or

• research funded by another person or governmental entity.

Annual Information Report Required

Persons claiming the sales tax exemption must submit an annual report that provides all information requested by the Comptroller’s office

as required by law, including the amount of qualified research performed in Texas, the number of employees engaged in research and

development in Texas and other data regarding sales tax and research expenditures. Reports are due March 31 each year and will cover

research activities conducted in the prior calendar year.

Failure to file the annual information report may result in revocation of the Qualified Research Registration Number.

Franchise Tax Research and Development Activities Credit

The law also provides for a research and development activities credit against the franchise tax. A person claiming the sales tax exemption

cannot claim the franchise tax credit for the same period.

Additional Information

Mail the completed application to

Comptroller of Public Accounts

111 E. 17th St.

Austin, TX 78774-0100

For more information, visit our Research and Development website at comptroller.texas.gov/taxes/qualified-research/. You can also

contact us online at comptroller.texas.gov/taxes/ or by phone at 1-800-252-5555.

Federal Privacy Act: Disclosure of your Social Security number is required and authorized under law, for the purpose of tax administration

and identification of any individual affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011 and 403.078. Release

of information on this form in response to a public information request will be governed by the Public Information Act, Chapter 552, Govern-

ment Code, and applicable federal law.

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about

you. Contact us at the address or numbers listed on this form.

AP-234-1 (Rev.3-17/4)

1

1 2

2 3

3