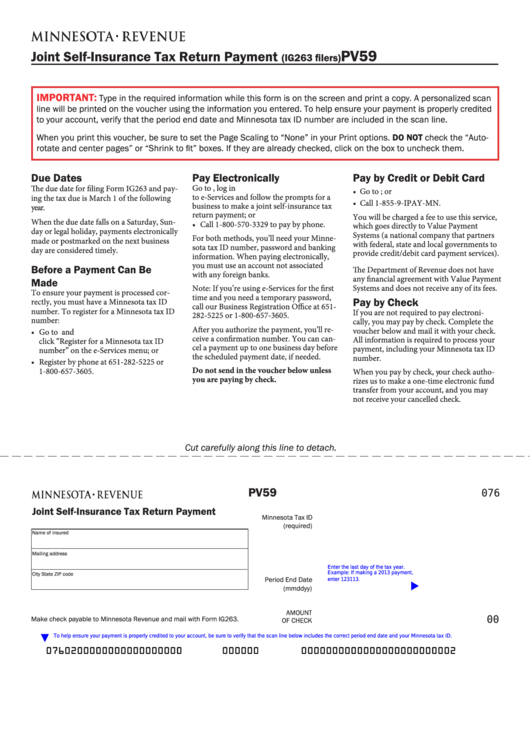

PV59

Joint Self-Insurance Tax Return Payment

(IG263 filers)

IMPORTANT:

Type in the required information while this form is on the screen and print a copy. A personalized scan

line will be printed on the voucher using the information you entered. To help ensure your payment is properly credited

to your account, verify that the period end date and Minnesota tax ID number are included in the scan line.

When you print this voucher, be sure to set the Page Scaling to “None” in your Print options. DO NOT check the “Auto-

rotate and center pages” or “Shrink to fit” boxes. If they are already checked, click on the box to uncheck them.

Due Dates

Pay Electronically

Pay by Credit or Debit Card

Go to , log in

The due date for filing Form IG263 and pay-

• Go to payMNtax.com; or

to e-Services and follow the prompts for a

ing the tax due is March 1 of the following

• Call 1‑855‑9‑IPAY‑MN.

business to make a joint self-insurance tax

year.

return payment; or

You will be charged a fee to use this service,

When the due date falls on a Saturday, Sun-

• Call 1‑800‑570‑3329 to pay by phone.

which goes directly to Value Payment

day or legal holiday, payments electronically

Systems (a national company that partners

For both methods, you’ll need your Minne-

made or postmarked on the next business

with federal, state and local governments to

sota tax ID number, password and banking

day are considered timely.

provide credit/debit card payment services).

information. When paying electronically,

you must use an account not associated

Before a Payment Can Be

The Department of Revenue does not have

with any foreign banks.

any financial agreement with Value Payment

Made

Note: If you’re using e-Services for the first

Systems and does not receive any of its fees.

To ensure your payment is processed cor-

time and you need a temporary password,

Pay by Check

rectly, you must have a Minnesota tax ID

call our Business Registration Office at 651‑

number. To register for a Minnesota tax ID

If you are not required to pay electroni-

282‑5225 or 1‑800‑657‑3605.

number:

cally, you may pay by check. Complete the

After you authorize the payment, you’ll re-

voucher below and mail it with your check.

• Go to and

ceive a confirmation number. You can can-

All information is required to process your

click “Register for a Minnesota tax ID

cel a payment up to one business day before

payment, including your Minnesota tax ID

number” on the e-Services menu; or

the scheduled payment date, if needed.

number.

• Register by phone at 651‑282‑5225 or

Do not send in the voucher below unless

1‑800‑657‑3605.

When you pay by check, your check autho-

you are paying by check.

rizes us to make a one-time electronic fund

transfer from your account, and you may

not receive your cancelled check.

Cut carefully along this line to detach.

PV59

076

Joint Self-Insurance Tax Return Payment

Minnesota Tax ID

(required)

Name of insured

Mailing address

Enter the last day of the tax year.

City

State

ZIP code

Example: If making a 2013 payment,

Period End Date

enter 123113.

u

(mmddyy)

AMOUNT

Make check payable to Minnesota Revenue and mail with Form IG263.

OF CHECK

00

To help ensure your payment is properly credited to your account, be sure to verify that the scan line below includes the correct period end date and your Minnesota tax ID.

0760200000000000000000123110000000

000000

0000000000000000000000002

1

1