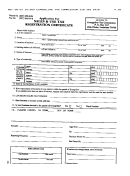

Form Btr-101 - Application For Wisconsin Business Tax Registration Page 2

ADVERTISEMENT

Part E. Business Location Information – All applicants

Trade name (DBA) if different from legal name

County

Business location address (no PO Box)

City

State

Zip

If yes, enter

your start date

At this location will you

(check yes to all that apply):

(

)

mm dd yyyy

• Sell certain food and beverages, automobile rentals, or lodging in Milwaukee County, including any part

of the Village of Bayside or the City of Milwaukee (see

Pub

410)? If yes, check all that apply . . . . . . . .

Yes

Food and Beverages

Automobile Rentals

Lodging

Lodging in the City of Milwaukee

• Primarily provide short term rentals of vehicles without drivers? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

• Provide limousine service? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

• Perform dry cleaning services? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

• Sell dry cleaning products? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

• Sell phone cards for prepaid wireless plans, voice communication services with an assigned

telephone number or prepaid wireless telecommunication plans? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

• Sell items as a retailer subject to the premier resort area tax (see

Pub

403)? If yes, check area(s) . . . .

Yes

Village of:

Lake Delton

City of:

Bayfield

Eagle River

Wisconsin Dells

Part F. Sales and Use Tax – Sales and use tax applicants

First date you will make

Enter Your

taxable sales or purchases.

Start Date

(

)

mm dd yyyy

Estimate monthly sales, leases, rentals or purchases subject to Wisconsin sales or use taxes

(check one):

$

1 - $ 900/month

$

901 - $ 7,200/month

$ 7,201 - $ 21,500/month

Over $21,500/month

If your income year does not end on December 31, enter the date your fiscal year ends.

(

mm dd yyyy

)

Nonprofit organization. Indicate the

date(s) of your taxable temporary event.

From:

To:

(

)

(

)

mm dd yyyy

mm dd yyyy

Will your business operate in WI all 12 months?

Yes

No If No, check the months it will operate in WI.

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Part G. Withholding Tax – Withholding tax applicants (FEIN required in Part C)

First date you will

Enter Your

pay employees.

Start Date

(

)

mm dd yyyy

Estimate monthly Wisconsin income tax withheld from employees

(check one):

$

1 - $25/month

$ 26 - $199/month

$ 200 - $1,666/month

Over $1,666/month

Will your business operate all 12 months?

Yes

No If No, check the months it will operate.

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Check if you hold no other Wisconsin tax permit and are:

An out-of-state employer not engaged in business in Wisconsin

An agricultural employer with farm labor only

A household employer with domestic employees only

If your withholding tax reports are prepared by a payroll service, complete the following:

Name of payroll service

FEIN

Phone number

(

)

- 2 -

BTR-101 (R. 12-13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4