Form Rpd-41342 - New Mexico Notice Of Transfer Of Sustainable Building Tax Credit Page 2

ADVERTISEMENT

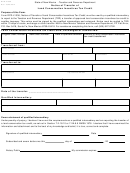

RPD-41342

Rev. 10/23/2014

INSTRUCTIONS FOR RPD-41342

NOTICE OF TRANSFER OF SUSTAINABLE BUILDING TAX CREDIT

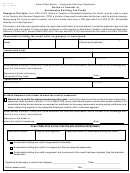

Transferred to. Complete this section to identify the new holder

COMPLETING THE NOTICE OF TRANSFER

of the approved sustainable building tax credit. You must mark

Follow these instructions to complete each section of RPD-41342,

the box to certify the statement, and sign and date to receive

Notice of Transfer of Sustainable Building Tax Credit.

the transfer.

Sustainable building tax credit sold, exchanged, or

Two Signatures and ENMRD Certificate

transferred. Enter the credit number and the approval date

Both transferring parties must sign and date the form. Mail

TRD assigned to the holder of the credit. You can find the credit

RPD-41342 to: Taxation and Revenue Department, Edit Error,

number and approval date on RPD-41327, Sustainable Building

P.O. Box 5418, Santa Fe, NM 87502-5418. For assistance

Tax Credit Approval, Section III or on RPD-41342, Notice of

completing this form, call (505) 827-0792.

Transfer of Sustainable Building Tax Credit, depending on the

how the previous holder recieved TRD approval for the credit.

IMPORTANT: You must mail the notice to TRD within 10 days

Enter the date of the transfer and the amount of the tax credit

of a sale, exchange, or other transfer.

to transfer.

Transferred from. Complete this section to identify the owner

or holder who transferred the approved sustainable building tax

credit. Sign and date to authorize the transfer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

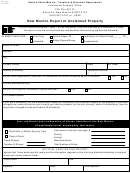

1

1 2

2