Secretary of State

Business Programs Division

Business Entities, 1500 11th Street, Sacramento, CA 95814

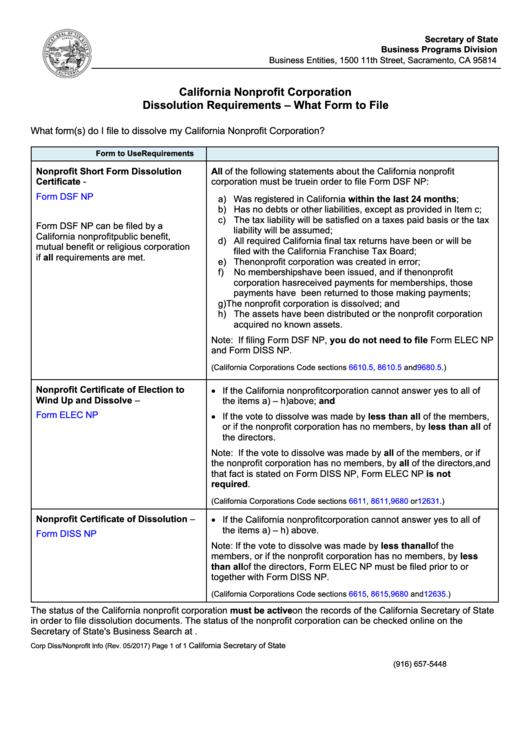

California Nonprofit Corporation

Dissolution Requirements – What Form to File

What form(s) do I file to dissolve my California Nonprofit Corporation?

Form to Use

Requirements

Nonprofit Short Form Dissolution

All of the following statements about the California nonprofit

Certificate -

corporation must be true in order to file Form DSF NP:

Form DSF NP

a) Was registered in California within the last 24 months;

b) Has no debts or other liabilities, except as provided in Item c;

c) The tax liability will be satisfied on a taxes paid basis or the tax

Form DSF NP can be filed by a

liability will be assumed;

California nonprofit public benefit,

d) All required California final tax returns have been or will be

mutual benefit or religious corporation

filed with the California Franchise Tax Board;

if all requirements are met.

e) The nonprofit corporation was created in error;

f)

No memberships have been issued, and if the nonprofit

corporation has received payments for memberships, those

payments have been returned to those making payments;

g) The nonprofit corporation is dissolved; and

h) The assets have been distributed or the nonprofit corporation

acquired no known assets.

Note: If filing Form DSF NP, you do not need to file Form ELEC NP

and Form DISS NP.

(California Corporations Code sections 6610.5,

8610.5

and 9680.5.)

Nonprofit Certificate of Election to

• If the California nonprofit corporation cannot answer yes to all of

Wind Up and Dissolve –

the items a) – h) above; and

Form ELEC NP

• If the vote to dissolve was made by less than all of the members,

or if the nonprofit corporation has no members, by less than all of

the directors.

Note: If the vote to dissolve was made by all of the members, or if

the nonprofit corporation has no members, by all of the directors, and

that fact is stated on Form DISS NP, Form ELEC NP is not

required.

(California Corporations Code sections 6611, 8611,

9680

or 12631.)

Nonprofit Certificate of Dissolution –

• If the California nonprofit corporation cannot answer yes to all of

the items a) – h) above.

Form DISS NP

Note: If the vote to dissolve was made by less than all of the

members, or if the nonprofit corporation has no members, by less

than all of the directors, Form ELEC NP must be filed prior to or

together with Form DISS NP.

(California Corporations Code sections 6615, 8615,

9680

and 12635.)

The status of the California nonprofit corporation must be active on the records of the California Secretary of State

in order to file dissolution documents. The status of the nonprofit corporation can be checked online on the

Secretary of State's Business Search at BusinessSearch.sos.ca.gov.

California Secretary of State

Corp Diss/Nonprofit Info (Rev. 05/2017)

Page 1 of 1

(916) 657-5448

1

1 2

2 3

3 4

4 5

5 6

6