Form Rpd-41247 - New Mexico Certificate Of Eligibility For The Rural Job Tax Credit Page 3

ADVERTISEMENT

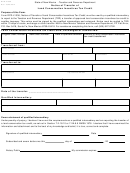

State of New Mexico - Taxation & Revenue Department

RPD-41247

Rev. 10/23/2014

INSTRUCTIONS FOR CERTIFICATE OF ELIGIBILITY FOR THE RURAL JOB TAX CREDIT

Page 2 of 2

Definition of Qualifying Period

A job shall not be eligible for a rural job tax credit pursuant

to this section if the job is created due to an eligible em-

“Qualifing Period” means the 12 months starting on the first

ployer entering into a contract or becoming a subcontractor

day of an eligible employee’s working in a qualifying job, or

to a contract with a governmental entity that replaces one or

12 months starting on the anniversary of the day the eligible

more entities performing functionally equivalent services for

employee begins working in a qualifying job.

the governmental entity in New Mexico unless the job is a

qualifying job that was not being performed by an employee

Definition of Tier Areas

of the replaced entity.

This credit is not available for jobs performed or based in

Los Alamos County, the cities of Albuquerque, Los Ranchos,

Definition of Wages

Corrales, Rio Rancho, Tijeras, Santa Fe, Las Cruces or

Effective July 1, 2013, wages means all compensation paid

Farmington, or within 10 road miles of any of these cities. Tier

by an eligible employer to an eligible employee through the

two areas are Roswell, Clovis, Carlsbad, Hobbs, Gallup and

employer’s payroll system, including those wages the em-

Alamogordo. Tier one area is anywhere within New Mexico

ployee elects to defer or redirect, such as the employee’s

not listed above.

contribution to 401(k) or cafeteria plan programs, but not

including benefits or the employer’s share of payroll taxes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3