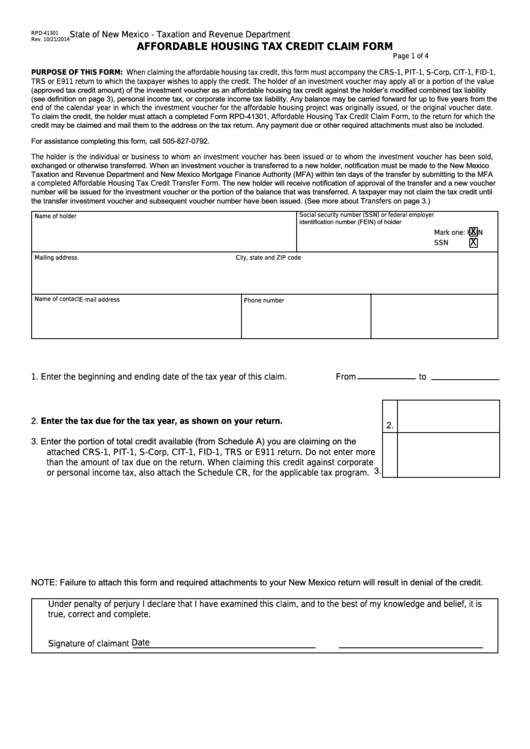

State of New Mexico - Taxation and Revenue Department

RPD-41301

Rev. 10/21/2014

AFFORDABLE HOUSING TAX CREDIT CLAIM FORM

Page 1 of 4

PURPOSE OF THIS FORM: When claiming the affordable housing tax credit, this form must accompany the CRS-1, PIT-1, S-Corp, CIT-1, FID-1,

TRS or E911 return to which the taxpayer wishes to apply the credit. The holder of an investment voucher may apply all or a portion of the value

(approved tax credit amount) of the investment voucher as an affordable housing tax credit against the holder’s modified combined tax liability

(see definition on page 3), personal income tax, or corporate income tax liability. Any balance may be carried forward for up to five years from the

end of the calendar year in which the investment voucher for the affordable housing project was originally issued, or the original voucher date.

To claim the credit, the holder must attach a completed Form RPD-41301, Affordable Housing Tax Credit Claim Form, to the return for which the

credit may be claimed and mail them to the address on the tax return. Any payment due or other required attachments must also be included.

For assistance completing this form, call 505-827-0792.

The holder is the individual or business to whom an investment voucher has been issued or to whom the investment voucher has been sold,

exchanged or otherwise transferred. When an investment voucher is transferred to a new holder, notification must be made to the New Mexico

Taxation and Revenue Department and New Mexico Mortgage Finance Authority (MFA) within ten days of the transfer by submitting to the MFA

a completed Affordable Housing Tax Credit Transfer Form. The new holder will receive notification of approval of the transfer and a new voucher

number will be issued for the investment voucher or the portion of the balance that was transferred. A taxpayer may not claim the tax credit until

the transfer investment voucher and subsequent voucher number have been issued. (See more about Transfers on page 3.)

Social security number (SSN) or federal employer

Name of holder

identification number (FEIN) of holder

Mark one:

FEIN

X

SSN

X

Mailing address

City, state and ZIP code

Name of contact

E-mail address

Phone number

1. Enter the beginning and ending date of the tax year of this claim.

From

to

2. Enter the tax due for the tax year, as shown on your return. .................................

2.

3. Enter the portion of total credit available (from Schedule A) you are claiming on the

attached CRS-1, PIT-1, S-Corp, CIT-1, FID-1, TRS or E911 return. Do not enter more

than the amount of tax due on the return. When claiming this credit against corporate

3.

or personal income tax, also attach the Schedule CR, for the applicable tax program.

NOTE: Failure to attach this form and required attachments to your New Mexico return will result in denial of the credit.

Under penalty of perjury I declare that I have examined this claim, and to the best of my knowledge and belief, it is

true, correct and complete.

Date

Signature of claimant

1

1 2

2 3

3 4

4