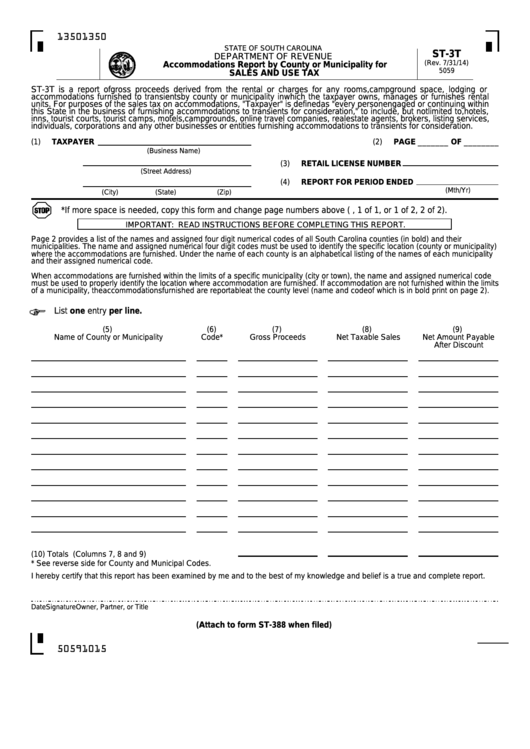

Form St-3t - South Carolina Accommodations Report By County Or Municipality For Sales And Use Tax

ADVERTISEMENT

1350

1350

STATE OF SOUTH CAROLINA

ST-3T

DEPARTMENT OF REVENUE

(Rev. 7/31/14)

Accommodations Report by County or Municipality for

5059

SALES AND USE TAX

ST-3T is a report of gross proceeds derived from the rental or charges for any rooms, campground space, lodging or

accommodations furnished to transients by county or municipality in which the taxpayer owns, manages or furnishes rental

units. For purposes of the sales tax on accommodations, "Taxpayer" is defined as "every person engaged or continuing within

this State in the business of furnishing accommodations to transients for consideration," to include, but not limited to, hotels,

inns, tourist courts, tourist camps, motels, campgrounds, online travel companies, real estate agents, brokers, listing services,

individuals, corporations and any other businesses or entities furnishing accommodations to transients for consideration.

(1)

TAXPAYER

(2)

PAGE _______ OF ________

(Business Name)

(3)

RETAIL LICENSE NUMBER

(Street Address)

(4)

REPORT FOR PERIOD ENDED

(Mth/Yr)

(City)

(State)

(Zip)

*If more space is needed, copy this form and change page numbers above (e.g., 1 of 1, or 1 of 2, 2 of 2).

IMPORTANT: READ INSTRUCTIONS BEFORE COMPLETING THIS REPORT.

Page 2 provides a list of the names and assigned four digit numerical codes of all South Carolina counties (in bold) and their

municipalities. The name and assigned numerical four digit codes must be used to identify the specific location (county or municipality)

where the accommodations are furnished. Under the name of each county is an alphabetical listing of the names of each municipality

and their assigned numerical code.

When accommodations are furnished within the limits of a specific municipality (city or town), the name and assigned numerical code

must be used to properly identify the location where accommodation are furnished. If accommodation are not furnished within the limits

of a municipality, the accommodations furnished are reportable at the county level (name and code of which is in bold print on page 2).

List one entry per line.

(5)

(6)

(7)

(8)

(9)

Name of County or Municipality

Code*

Gross Proceeds

Net Taxable Sales

Net Amount Payable

After Discount

(10) Totals (Columns 7, 8 and 9) .......................................

* See reverse side for County and Municipal Codes.

I hereby certify that this report has been examined by me and to the best of my knowledge and belief is a true and complete report.

Date

Signature

Owner, Partner, or Title

(Attach to form ST-388 when filed)

50591015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2