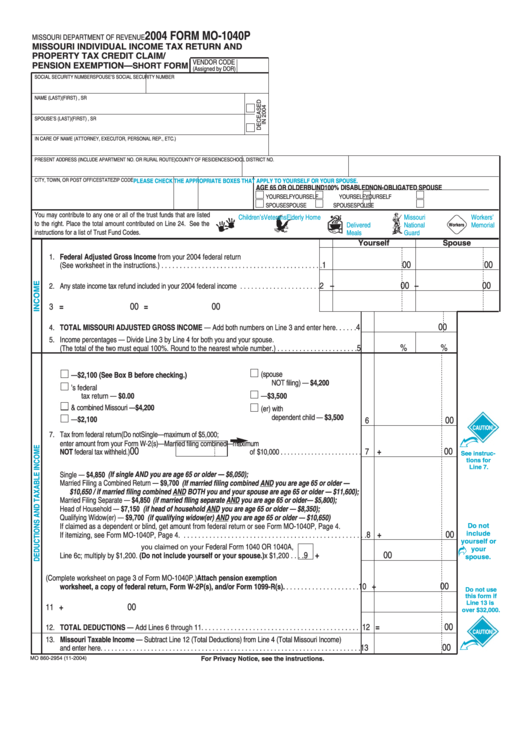

Form Mo-1040p - Missouri Individual Income Tax Return And Property Tax Credit Claim/pension Exemption - Short Form - 2004

ADVERTISEMENT

2004 FORM MO-1040P

MISSOURI DEPARTMENT OF REVENUE

MISSOURI INDIVIDUAL INCOME TAX RETURN AND

PROPERTY TAX CREDIT CLAIM/

VENDOR CODE

PENSION EXEMPTION— SHORT FORM

(Assigned by DOR)

SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER

NAME (LAST)

(FIRST)

M.I.

JR, SR

SPOUSE’S (LAST)

(FIRST)

M.I.

JR, SR

IN CARE OF NAME (ATTORNEY, EXECUTOR, PERSONAL REP., ETC.)

PRESENT ADDRESS (INCLUDE APARTMENT NO. OR RURAL ROUTE)

COUNTY OF RESIDENCE

SCHOOL DISTRICT NO.

CITY, TOWN, OR POST OFFICE

STATE

ZIP CODE

PLEASE CHECK THE APPROPRIATE BOXES THAT APPLY TO YOURSELF OR YOUR SPOUSE.

AGE 65 OR OLDER

BLIND

100% DISABLED

NON-OBLIGATED SPOUSE

YOURSELF

YOURSELF

YOURSELF

YOURSELF

SPOUSE

SPOUSE

SPOUSE

SPOUSE

You may contribute to any one or all of the trust funds that are listed

Children’s

Veterans

Elderly Home

Missouri

Workers’

to the right. Place the total amount contributed on Line 24. See the

Delivered

National

Memorial

Workers

instructions for a list of Trust Fund Codes.

Meals

Guard

Yourself

Spouse

1. Federal Adjusted Gross Income from your 2004 federal return

00

00

1

(See worksheet in the instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

2 –

–

2. Any state income tax refund included in your 2004 federal income . . . . . . . . . . . . . . . . . . . . . .

00

00

3 =

=

3. Subtract Line 2 from Line 1. This is your Missouri adjusted gross income. . . . . . . . . . . . . .

00

4

4. TOTAL MISSOURI ADJUSTED GROSS INCOME — Add both numbers on Line 3 and enter here. . . . . .

5. Income percentages — Divide Line 3 by Line 4 for both you and your spouse.

%

%

5

(The total of the two must equal 100%. Round to the nearest whole number.) . . . . . . . . . . . . . . . . . . . . . .

6. Mark your filing status box below and enter the appropriate exemption amount on Line 6.

E. Married filing separate (spouse

A. Single — $2,100 (See Box B before checking.)

NOT filing) — $4,200

B. Claimed as a dependent on another person’s federal

tax return — $0.00

F. Head of household — $3,500

C. Married filing joint federal & combined Missouri — $4,200

G. Qualifying widow(er) with

dependent child — $3,500

D. Married filing separate — $2,100

00

6

CAUTION!

7. Tax from federal return (Do not

Single—maximum of $5,000;

enter amount from your Form W-2(s)—

Married filing combined—maximum

00

00

7 +

NOT federal tax withheld.)

of $10,000 . . . . . . . . . . . . . . . . . . . . . . . .

See instruc-

tions for

8. Missouri standard deduction or itemized deductions

Line 7.

Single — $4,850 (If single AND you are age 65 or older — $6,050);

Married Filing a Combined Return — $9,700 (If married filing combined AND you are age 65 or older —

$10,650 / if married filing combined AND BOTH you and your spouse are age 65 or older — $11,600);

Married Filing Separate — $4,850 (if married fIling separate AND you are age 65 or older— $5,800);

Head of Household — $7,150 (if head of household AND you are age 65 or older — $8,350);

Qualifying Widow(er) — $9,700 (if qualifying widow(er) AND you are age 65 or older — $10,650)

If claimed as a dependent or blind, get amount from federal return or see Form MO-1040P, Page 4.

Do not

00

include

8 +

If itemizing, see Form MO-1040P, Page 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

yourself or

9. Total number of dependents

Federal Form 1040 OR 1040A,

you claimed on your

your

00

9 +

Line 6c; multiply by $1,200. (Do not include yourself or your spouse.)

x $1,200 . . . .

spouse.

10. Pension exemption (Complete worksheet on page 3 of Form MO-1040P.) Attach pension exemption

00

10 +

worksheet, a copy of federal return, Form W-2P(s), and/or Form 1099-R(s). . . . . . . . . . . . . . . . . . . . .

Do not use

this form if

Line 13 is

00

11 +

11. Long-term care insurance deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

over $32,000.

00

12 =

12. TOTAL DEDUCTIONS — Add Lines 6 through 11. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

CAUTION!

13. Missouri Taxable Income — Subtract Line 12 (Total Deductions) from Line 4 (Total Missouri Income)

00

13

and enter here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

MO 860-2954 (11-2004)

For Privacy Notice, see the instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4