Print

Clear

(Rev. 7/12)

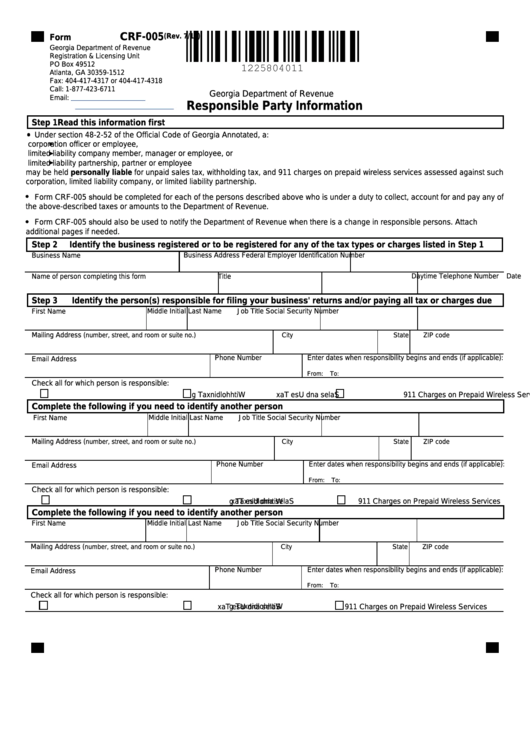

CRF-005

Form

Georgia Department of Revenue

Registration & Licensing Unit

PO Box 49512

Atlanta, GA 30359-1512

Fax: 404-417-4317 or 404-417-4318

Call: 1-877-423-6711

Georgia Department of Revenue

Email:

ST-License@dor.ga.gov

Responsible Party Information

TSD-withholding-lic@dor.ga.gov

Step 1

Read this information first

Under section 48-2-52 of the Official Code of Georgia Annotated, a:

corporation officer or employee,

limited liability company member, manager or employee, or

limited liability partnership, partner or employee

may be held personally liable for unpaid sales tax, withholding tax, and 911 charges on prepaid wireless services assessed against such

corporation, limited liability company, or limited liability partnership.

Form CRF-005 should be completed for each of the persons described above who is under a duty to collect, account for and pay any of

the above-described taxes or amounts to the Department of Revenue.

Form CRF-005 should also be used to notify the Department of Revenue when there is a change in responsible persons. Attach

additional pages if needed.

Step

2

Identify the business registered or to be registered for any of the tax types or charges listed in Step 1

Business Name

Business Address

Federal Employer Identification Number

Daytime Telephone Number

Date

Name of person completing this form

Title

Step 3

Identify the person(s) responsible for filing your business' returns and/or paying all tax or charges due

First Name

Middle Initial Last Name

Job Title

Social Security Number

Mailing Address (

number, street, and room or suite no.)

City

State

ZIP code

Phone Number

Enter dates when responsibility begins and ends (if applicable):

Email Address

From:

To:

Check all for which person is responsible:

S

l a

s e

a

n

d

U

s

e

T

x a

W

i

h t

h

o

d l

n i

g Tax

911 Charges on Prepaid Wireless Services

Complete the following if you need to identify

another person

First Name

Middle Initial Last Name

Job Title

Social Security Number

Mailing Address (

number, street, and room or suite no.)

City

State

ZIP code

Phone Number

Enter dates when responsibility begins and ends (if applicable):

Email Address

From:

To:

Check all for which person is responsible:

S

l a

s e

a

n

d

U

s

e

T

x a

911 Charges on Prepaid Wireless Services

W

i

h t

h

o

d l

n i

g Tax

Complete the following if you need to identify another person

First Name

Middle Initial Last Name

Job Title

Social Security Number

Mailing Address (

number, street, and room or suite no.)

City

State

ZIP code

Phone Number

Enter dates when responsibility begins and ends (if applicable):

Email Address

From:

To:

Check all for which person is responsible:

S

l a

s e

a

n

d

U

s

e

T

x a

W

i

h t

h

o

d l

n i

g Tax

911 Charges on Prepaid Wireless Services

1

1