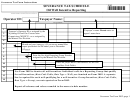

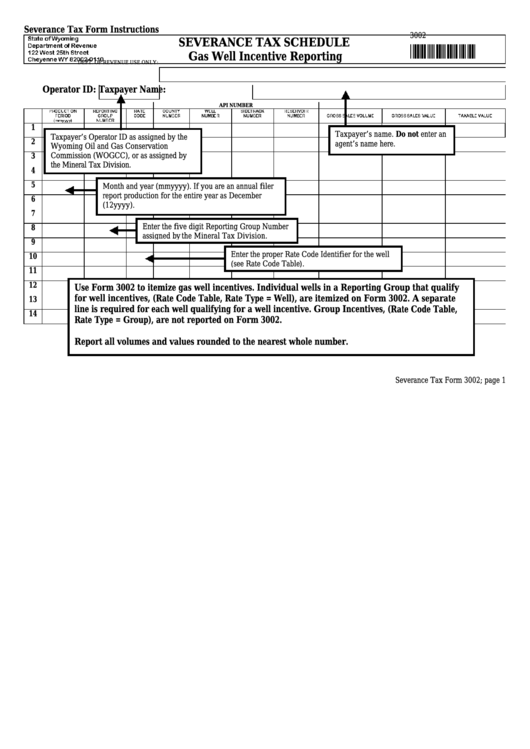

Severance Tax Schedule (Severance Tax Form 3002) - Gas Well Incentive Reporting

ADVERTISEMENT

Severance Tax Form Instructions

6WDWH RI :\RPLQJ

3002

SEVERANCE TAX SCHEDULE

'HSDUWPHQW RI 5HYHQXH

:HVW WK 6WUHHW

Gas Well Incentive Reporting

&KH\HQQH :<

DEPT. OF REVENUE USE ONLY:

Operator ID:

Taxpayer Name:

API NUMBER

352'8&7,21

5(3257,1*

5$7(

&2817<

:(//

6,'(75$&.

5(6(592,5

3(5,2'

*5283

&2'(

180%(5

180%(5

180%(5

180%(5

*5266 6$/(6 92/80(

*5266 6$/(6 9$/8(

7$;$%/( 9$/8(

PP\\\\

180%(5

1

Taxpayer’s name. Do not enter an

Taxpayer’s Operator ID as assigned by the

2

agent’s name here.

Wyoming Oil and Gas Conservation

Commission (WOGCC), or as assigned by

3

the Mineral Tax Division.

4

5

Month and year (mmyyyy). If you are an annual filer

report production for the entire year as December

6

(12yyyy).

7

Enter the five digit Reporting Group Number

8

assigned by the Mineral Tax Division.

9

Enter the proper Rate Code Identifier for the well

10

(see Rate Code Table).

11

12

Use Form 3002 to itemize gas well incentives. Individual wells in a Reporting Group that qualify

for well incentives, (Rate Code Table, Rate Type = Well), are itemized on Form 3002. A separate

13

line is required for each well qualifying for a well incentive. Group Incentives, (Rate Code Table,

14

Rate Type = Group), are not reported on Form 3002.

Report all volumes and values rounded to the nearest whole number.

Severance Tax Form 3002; page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4