Property Tax Form 82504 - Electric Transmission & Distribution Companies And Gas Distribution Companies - 2014 Page 11

ADVERTISEMENT

CONFIDENTIAL

BY SIGNING THE VERIFICATION PAGE, THE TAXPAYER WAIVES ALL CONFIDENTIALITY REQUIREMENTS OF A.R.S.

42-2001 THROUGH

42-2004 WITH RESPECT TO THIS PAGE AND CONSENTS TO THE DISCLOSURE OF THE CONTENTS OF THIS PAGE TO COUNTY ASSESSOR

PERSONNEL BY THE ARIZONA DEPARTMENT OF REVENUE.

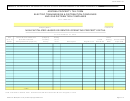

ARIZONA PROPERTY TAX FORM

ELECTRIC TRANSMISSION & DISTRIBUTION COMPANIES

AND GAS DISTRIBUTION COMPANIES

TAX YEAR 2014

Company Name

CVP Tax ID

NON-OPERATING PROPERTY

(Land parcels located in Arizona not used in transmission or distribution operations)

Year Ending December 31, 2012

Tax

Area

Assessor's Parcel Number

County

Code

(Book, Map, Parcel)

Property Description

Acres

(a)

(b)

(c)

(d)

(e)

DOR Form 82054 (Rev 12-12).xls Non Op Property-Tab 8

Page 8 of 9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12