Form Ftb 3071 Meo - Head Of Household Information Request

ADVERTISEMENT

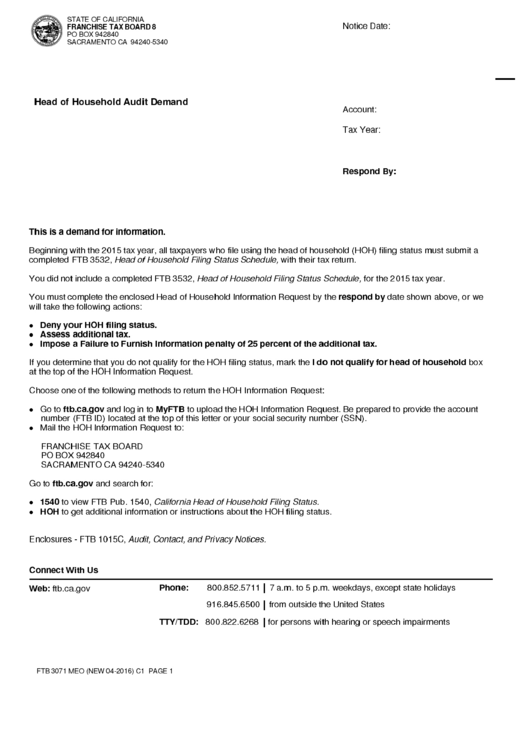

STATE OF CALIFORNIA

FRANCHISE TAX BOARD 8

Notice Date:

PO BOX 942840

SACRAMENTO CA 94240-5340

Head of Household Audit Demand

Account:

Tax Year:

Respond By:

This is a demand for information.

Beginning with the 2015 tax year, all taxpayers who file using the head of household (HOH) filing status must submit a

Head of Household Filing Status Schedule,

completed FTB 3532,

with their tax return.

Head of Household Filing Status Schedule,

You did not include a completed FTB 3532,

for the 2015 tax year.

respond by

You must complete the enclosed Head of Household Information Request by the

date shown above, or we

will take the following actions:

Deny your HOH filing status.

●

Assess additional tax.

●

Impose a Failure to Furnish Information penalty of 25 percent of the additional tax.

●

I do not qualify for head of household

If you determine that you do not qualify for the HOH filing status, mark the

box

at the top of the HOH Information Request.

Choose one of the following methods to return the HOH Information Request:

ftb.ca.gov

MyFTB

●

Go to

and log in to

to upload the HOH Information Request. Be prepared to provide the account

number (FTB ID) located at the top of this letter or your social security number (SSN).

●

Mail the HOH Information Request to:

FRANCHISE TAX BOARD

PO BOX 942840

SACRAMENTO CA 94240-5340

ftb.ca.gov

Go to

and search for:

1540

California Head of Household Filing Status.

●

to view FTB Pub. 1540,

HOH

●

to get additional information or instructions about the HOH filing status.

Audit, Contact, and Privacy Notices.

Enclosures - FTB 1015C,

Connect With Us

Phone:

Web:

800.852.5711

7 a.m. to 5 p.m. weekdays, except state holidays

ftb.ca.gov

916.845.6500

from outside the United States

TTY/TDD:

800.822.6268

for persons with hearing or speech impairments

FTB 3071 MEO (NEW 04-2016) C1 PAGE 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6