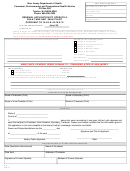

BF-1

A

D

R

1/04

LABAMA

EPARTMENT OF

EVENUE

S

, U

& B

T

D

ALES

SE

USINESS

AX

IVISION

Application to Become a Bulk Filer

Name: ___________________________________________________________________________________________

Address: _________________________________________________________________________________________

City: ____________________________________________ State: _______________________ Zip: ________________

Telephone Number: (______)________________ Federal ID Number: ________________________________________

Contact Person:______________________________________ Contact’s Telephone Number: (______)_______________

Contact’s Fax Number: (______)_______________ Contact’s E-Mail Address: __________________________________

Officers:

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

_________________________________________________________________________________________________

Type of Organization (i.e. Corporation, Proprietorship, etc.): _________________________________________________

By submitting this application, the above party agrees to abide by the laws and statutes of Alabama in the filing of returns

on behalf of Alabama taxpayers. This application in no way grants power of attorney for this party to act on behalf of the

taxpayer in matters involving tax disputes. This application does not grant the above party authority to act as an agent of

the Department of Revenue. Any agency relationship would exist between the above party and their client(s).

All returns must be timely filed and paid electronically over the Internet using the Alabama Paperless Filing System. As a

third party bulk filer, you have the option to either enter each client’s filing information on-screen or send an electronic file

that contains the information for your clients. Note: One EFT payment cannot cover multiple accounts.

As a third party bulk filer with the State of Alabama, you are required to:

• Permit the Alabama Department of Revenue to conduct scheduled or unscheduled audits;

• Provide the Department of Revenue with a copy of any client contract upon request. At the time the request is

made, the Department will also request a copy of a valid power of attorney allowing you to file and/or pay

Alabama taxes on behalf of the client. The power of attorney must also allow you to receive information about

those filings or payments directly from the Department.

• Provide the Department of Revenue an electronic initial list of all clients and provide electronic updates on a

monthly basis. (Updates should show only additions and deletions.)

ALL CLIENTS SHOULD BE REGISTERED WITH THE

ALABAMA DEPARTMENT OF REVENUE AND HAVE VALID ACCOUNTS.

If the Department of Revenue determines that your continued business operation presents a risk of loss to your clients, the

Department can suspend your registration and notify your clients of the suspension. The Department can also revoke your

registration and/or assess a penalty if the Department determines that you are not in compliance with the law.

Signature of Officer,

Proprietor, Partner, etc.: _________________________________________________ Date: _______________________

Upon completion of this application, please fax to (334) 353-7666.

If you have any questions concerning this application, please call (334) 242-1490 or 1-866-576-6531.

1

1