Supplemental Quarterly Schedule To Focus Report Derivatives And Other Off-Balance Sheet Items

ADVERTISEMENT

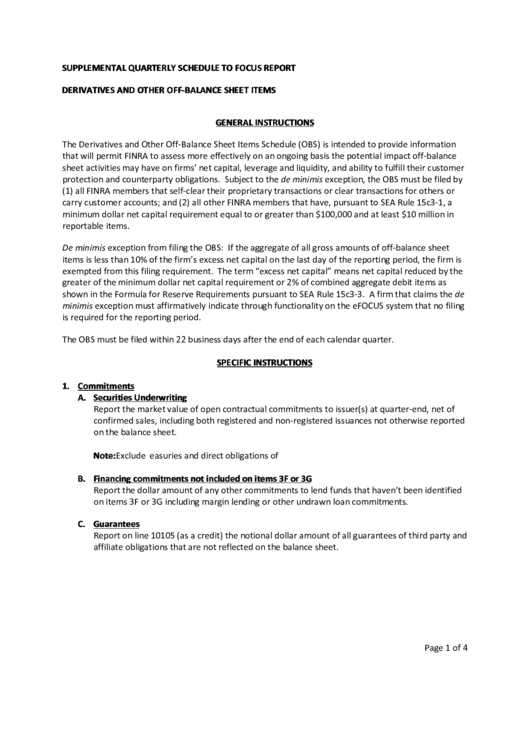

SUPPLEMENTAL QUARTERLY SCHEDULE TO FOCUS REPORT

DERIVATIVES AND OTHER OFF-BALANCE SHEET ITEMS

GENERAL INSTRUCTIONS

The Derivatives and Other Off-Balance Sheet Items Schedule (OBS) is intended to provide information

that will permit FINRA to assess more effectively on an ongoing basis the potential impact off-balance

sheet activities may have on firms’ net capital, leverage and liquidity, and ability to fulfill their customer

protection and counterparty obligations. Subject to the de minimis exception, the OBS must be filed by

(1) all FINRA members that self-clear their proprietary transactions or clear transactions for others or

carry customer accounts; and (2) all other FINRA members that have, pursuant to SEA Rule 15c3-1, a

minimum dollar net capital requirement equal to or greater than $100,000 and at least $10 million in

reportable items.

De minimis exception from filing the OBS: If the aggregate of all gross amounts of off-balance sheet

items is less than 10% of the firm’s excess net capital on the last day of the reporting period, the firm is

exempted from this filing requirement. The term “excess net capital” means net capital reduced by the

greater of the minimum dollar net capital requirement or 2% of combined aggregate debit items as

shown in the Formula for Reserve Requirements pursuant to SEA Rule 15c3-3. A firm that claims the de

minimis exception must affirmatively indicate through functionality on the eFOCUS system that no filing

is required for the reporting period.

The OBS must be filed within 22 business days after the end of each calendar quarter.

SPECIFIC INSTRUCTIONS

1. Commitments

A. Securities Underwriting

Report the market value of open contractual commitments to issuer(s) at quarter-end, net of

confirmed sales, including both registered and non-registered issuances not otherwise reported

on the balance sheet.

Note: Exclude U.S. Treasuries and direct obligations of U.S. Federal Agencies.

B. Financing commitments not included on items 3F or 3G

Report the dollar amount of any other commitments to lend funds that haven’t been identified

on items 3F or 3G including margin lending or other undrawn loan commitments.

C. Guarantees

Report on line 10105 (as a credit) the notional dollar amount of all guarantees of third party and

affiliate obligations that are not reflected on the balance sheet.

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6