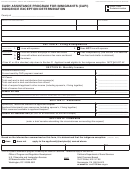

STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

CASH ASSISTANCE PROGRAM FOR IMMIGRANTS (CAPI)

INCOME ELIGIBILITY - ADULT

NAME

CASE NO.

MONTH/YEAR

RECIPIENT(S)

RECIPIENT WITH INELIGIBLE SPOUSE

A.

Income of individual, or couple where both members are receiving,

B.

Income of individual who is receiving or applying for CAPI, and a

or applying for, CAPI and/or SSI/SSP. Show gross amounts of all

spouse who is not eligible or applying for CAPI and/or SSI/SSP.

non-excluded income.

Show gross amounts of all non-excluded income.*

UNEARNED

EARNED

UNEARNED

EARNED

1. a. Social Security and other pensions

1. Income of ineligible spouse

b. In-Kind Support

2. Allowance for ineligible children**

c. Income deemed from Sponsor

a. Amount**

d. Other unearned income

b. Children’s inc.

2. Total unearned income. (Add 1a - 1d)

c. Net allowance

(a minus b)

3. General Exclusion

$20.00

d. Total allowance (sum of B2c’s)

4. Subtract A3 from A2. Enter result.

3. Remaining unearned income

(B1 minus B2d)

5. Income based on need (CalWORKs, VA

4. Unused allowance (If B2d is greater

pension, etc.)

than B1, enter the difference)

6. Add A4 and A5. Enter result.

5. Remaining earned income (B1 minus B4)

7. Self Support Plan exclusion

6. CAPI recipient's income

(from A2 and A9)

8. Countable Unearned Income. Subtract 7.

7. Couple’s income (B3 plus B6

From 6. Enter result.

unearned, B5 plus B6 earned)

9. Earned Income

8. General Exclusion

$20.00

10. Unused $20 exclusion from above.

9. Net unearned (B7 minus B8)

11. Earned income exclusion

$65.00

10. Income based on need (CalWORKs,

VA pension)***

12. Total exclusions (A10 plus A11)

11. Add B9 plus B10. Enter result.

13. Subtract A12 from A9. Enter result.

12. Self Support Plan exclusion

14. IRWE

13. Countable Unearned Income

(B11 minus B12)

15. Subtract A14 from A13. Enter result.

14. Unused portion of $20 exclusion

from above.

16. Divide A15 by 2. Enter result.

15. Earned income exclusion

$65.00

17. Blind work expenses and remaining

16. Total exclusions (B14 plus B15)

self support plan.

18. Earned Countable Income

17. Subtract B16 from B7. Enter result.

(A16 minus A17)

19. Total countable income (A8 plus A18).

18. IRWE

20. CAPI payment standard.

19. Subtract B18 from B17. Enter result.

21. CAPI payment (A20 minus A19).

20. Divide B19 by 2. Enter result.

21. Blind work expenses and remaining

* Also complete column A using only the individual’s income.

self support plan.

22. Earned Countable Income

** Ineligible child’s allowance equals the difference between the

federal SSI standard for an individual and the SSI standard for a

(B20 minus B21)

couple ($247 as of Jan. 1, 1998). If the ineligible spouse’s income

23. Total Countable Income

is less than this amount, deeming does not apply and the CAPI

(B13 plus B22)

payment will be based on the individual’s own income under

24. CAPI couple payment standard.

column A.

25. Potential CAPI payment based on

*** If the ineligible spouse is receiving assistance based on need,

deemed income (B24 minus B23).

deeming does not apply and the CAPI payment will be based on

C. Actual CAPI payment is the

the individual’s own income under column A.

smaller of B25 or A21

SUPERVISOR’S SIGNATURE

DATE

WORKER

DATE

SOC 452 (4/99)

1

1