Instructions For Form Et-1c - Consolidated Financial Institution Excise Tax - 2017

ADVERTISEMENT

I

F

T

P

NSTRUCTIONS

OR

HE

REPARATION OF

A

D

R

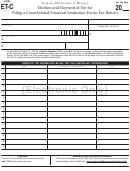

FORM

LABAMA

EPARTMENT OF

EVENUE

Consolidated Financial Institution Excise Tax

ET-1C

2017

INSTRUCTIONS

Alabama Financial Institutions Excise Tax law, regulations, forms and instructions are available

on the Alabama Department of Revenue’s website at

What’s New for 2016

couraged to remit Alabama ET-8 and payment electronically. Payments of $750

or more must be remitted electronically.

Credit Limitation. Act Number 2016-280 passed the Alabama Legislature during

NOTE: The Alabama parent should remit Form ET-8 on behalf of all of the compa-

the 2016 Regular Session. The act provides that tax credits may only be used to off-

nies included in the consolidated election.

set the state portion of the tax liability. For tax credits enacted beginning on or after

January 1, 2016, financial institution excise taxpayers' tax credits shall be applied only

Payment of Tax

to the state portion of the tax liability and shall not offset or reduce the Financial In-

stitution Excise tax distribution pursuant to Section 40-16-6, Code of Alabama 1975.

The total amount of the excise tax liability for the period is due on or before the un-

Tie to MTC Allocation and Apportionment formula. Though Act Number 2016-

extended due date of the return. If the return is to be filed under extension, any liabil-

283 severed the statutory tie to the MTC’s model allocation and apportionment for-

ity due should be remitted no later than the original due date of the return.

mula, Alabama rules still conform to this model. Revisions to the new MTC model will

Section 41-1-20 requires electronic payments for all single business tax payments

be effective in Alabama starting in 2017. See Alabama Rule 810-9-1-.05.

of $750 or more. Substantial penalties will be assessed for noncompliance. Pay-

ments of $750 or more must be made electronically. Non-electronic payments must

General Information for Financial Institutions

be remitted with Form FIE-V. DO NOT MAIL FORM FIE-V IF THE PAYMENT IS RE-

Filing a Consolidated Return

MITTED ELECTRONICALLY.

Electronic Payment Options available:

Alabama Form ET-1C must be filed by taxpayers meeting the definition of finan-

My Alabama Taxes (MAT) – Taxpayers who have an account with the Alabama

cial institutions (as defined in Section 40-16-1, Code of Alabama 1975) that have prop-

erly elected to file a consolidated financial institutions excise tax return.

Department of Revenue may register and make electronic payments using MAT. Visit

the Department’s website at (click the MAT icon on the

Form ET-1C is an annual return due on April 15th of each excise tax year. The fi-

home page).

nancial institutions excise tax is payable on or before April 15th of the excise tax year.

ACH Credit – Taxpayers making electronic payments via ACH Credit must be

The Alabama taxable income, computed and reported on the form, is for the last tax-

pre-approved by ADOR. To register, complete and submit Form EFT: 001 entitled

able year of the financial institution ended prior to April 1 of the excise tax year.

EFT Authorization Agreement Form. Visit our website at alabama.

EXAMPLE: The 2017 Alabama Form ET-1C is due on April 15, 2017. If April 15

gov/eservices.htm for additional information.

falls on a Saturday, Sunday, or state holiday, the return and payment will be due the

following business day. Payment of the tax liability shown on the 2017 Form ET-1C

Technical assistance with making a payment using ACH Credit, call the toll

allows the taxpayer to engage in the business of being a financial institution in the

free hotline (1-877-256-2447) from 8:00 a.m. through 5:00 p.m. (Central Stan-

dard Time)

State of Alabama for the 2016 calendar year. If the taxpayer is a calendar year tax-

payer, the Alabama taxable income computed and shown due on the 2017 Form ET-

Make check or money order payable to: Alabama Department of Revenue

1C is based on the operations of the 2016 calendar year.

In order for the qualified corporate group to be able to file a consolidated return,

Preparation Instructions

the financial institution members must meet the definition of a financial institution found

Taxpayers filing consolidated financial institution excise tax returns will submit

in Section 40-16-1 of the Code of Alabama 1975. The members must also meet the

completed proforma Forms ET-1 for each of the separate companies included in the

ownership requirement and filing requirement specified in Section 40-16-3, Code of

consolidated excise group. A proforma Form ET-1 is a completed Form ET-1 with fil-

Alabama 1975.

ing status 4 checked. In addition to a proforma Form ET-1, the Alabama parent will

Annual Consolidated Filing Election and Fee

complete Form ET-1C. Form ET-1C was designed to summarize the separate com-

pany information from each of the proforma Form ET-1 returns for each of the mem-

In order for a financial institution excise group to file a consolidated financial in-

bers of the consolidated excise group. All financial information for the group will be

stitution excise return, the parent of the group must meet the ownership and filing re-

summarized on the Form ET-1C. Tax due for the group will be computed on Form ET-

quirements, specified in Section 40-16-3, Code of Alabama and timely file an election

1C. Petitions for refund for the consolidated group will also be requested using the

to file consolidated (Form ET-C). Financial institutions that file federal Form 1120S

Form ET-1C. Any tax payments for the consolidated group should be made by the

(U.S. Income Tax Return for an S Corporation) are not required to file Alabama Form

Alabama parent and claimed on Form ET-1C.

ET-1C nor are they required to make a consolidated election (Form ET-C) for Ala-

bama purposes. Alabama treats an S Corporation and its qualified subchapter S sub-

NOTE: For line by line instructions for proforma Form ET-1, please see the instruc-

sidiaries as one entity. Form ET-1 should be filed instead of Form ET-1C. Form ET-C

tions for Form ET-1. These instructions will only provide line by line instructions for the

must be received by the Department of Revenue on or before April 15 of the excise

Form ET-1C.

tax year. In addition to Form ET-C, the parent must also remit a $6000 consolidated

REQUIRED ATTACHMENTS. For the Consolidated Financial Institutions Excise

filing fee. Form ET-C and the required fee must both be remitted electronically. Please

Tax return to be considered complete, a complete signed copy of the applicable

visit our website at alabama.gov and select E Services.

federal income tax return must be attached. Failure to attach the complete fed-

Extension to file Alabama Form ET-1C

eral return and supporting schedules may result in the imposition of delinquent

and/or frivolous return penalties. A complete federal return includes consolidated

Alabama Form ET-8, Application for Extension of Time for Filing Alabama Finan-

income spreadsheets, consolidated balance sheets, consolidated Schedules M-1, M-

cial Institution Excise Return, may be used to request an extension for either 3 months

2, M-3, Schedule UTP, as well as supporting schedules for each of these items bro-

or 6 months. If requesting a three (3) month extension, 50% of the estimated tax due

ken down by each separate company included in the consolidated federal group.

must be remitted with the extension request on or before April 15th. The balance plus

interest must be remitted with the return when filed on or before July 15th. If request-

If the parent of the consolidated excise group incurs a current year loss, a com-

ing a six (6) month extension, the entire estimated tax due must be remitted with the

putation of the parent company loss allocation must be included as an attachment to

extension request by April 15th. The return will be due on or before October 15th.

the consolidated excise tax return. The parent company loss allocation must be made

Taxpayers who request extension of time to file Alabama Form ET-1C are en-

in accordance with Alabama excise tax rule 810-9-1-.01(4)(j)2.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2