BURDEN ESTIMATE STATEMENT

The estimated average burden associated with this collection of information is 10 minutes per respondent or record-

keeper, depending on individual circumstances. Comments concerning the accuracy of this burden estimate and sug

gestions for reducing this burden should be directed to the Financial Management Service, Facilities Management

Division, Property & Supply Section, Room B-101, 3700 East-West Highway, Hyattsville, MD 20782 or the Office

of Management and Budget, Paperwork Reduction Project (1510-0007), Washington, D.C. 20503.

PLEASE READ THIS CAREFULLY

All information on this form, including the individual claim number, is required under 31 USC

3322, 31 CFR 209 and/or 210. The information is confidential and is needed to prove entitlement to

payments. The information will be used to process payment data from the Federal agency to the finan

cial institution and/or its agent. Failure to provide the requested information may affect the process

ing of this form and may delay or prevent the receipt of payments through the Direct Deposit/Elec

tronic Funds Transfer Program.

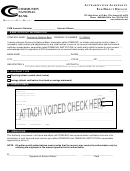

INFORMATION FOUND ON CHECKS

Most of the information needed to complete

United States Treasury

15-51

boxes A, C, and F in Section 1 is printed on your

000

Check No.

0000 - 4157815

government check:

Month

Day

Year

AUSTIN, TEXAS

08

31 84

A Be sure that the payee’s name is written exactly as it ap

DOLLARS

CTS

29-693-775

00

C

Pay to

28

28

pears on the check. Be sure current address is shown.

theorder of

JOHN DOE

$****100*00

VA COMP

123 BRISTOL STREET

HAWKINS BRANCH, TX 76543

F

C Claim numbers and suffixes are printed here on

A

checks beneath the date for the type of payment

shown here. Check the Green Book for the location

NOT NEGOTIABLE

of prefixes and suffixes for other types of payments.

F Type of payment is printed to the left of the amount.

SPECIAL NOTICE TO JOINT ACCOUNT HOLDERS

Joint account holders should immediately advise both the Government agency and the finan

cial institution of the death of a beneficiary. Funds deposited after the date of death or ineligibility,

except for salary payments, are to be returned to the Government agency. The Government agency

will then make a determination regarding survivor rights, calculate survivor benefit payments, if any,

and begin payments.

CANCELLATION

The agreement represented by this authorization remains in effect until canceled by the reci

pient by notice to the Federal agency or by the death or legal incapacity of the recipient. Upon cancella

tion by the recipient, the recipient should notify the receiving financial institution that he/she is

doing so.

The agreement represented by this authorization may be cancelled by the financial institution

by providing the recipient a written notice 30 days in advance of the cancellation date. The recipient

must immediately advise the Federal agency if the authorization is cancelled by the financial institu

tion. The financial institution cannot cancel the authorization by advice to the Government agency.

CHANGING RECEIVING FINANCIAL INSTITUTIONS

The payee’s Direct Deposit will continue to be received by the selected financial institution until

the Government agency is notified by the payee that the payee wishes to change the financial in

stitution receiving the Direct Deposit. To effect this change, the payee will complete the new SF 1199A

at the newly selected financial institution. It is recommended that the payee maintain accounts at

both financial institutions until the transition is complete, i.e. after the new financial institution receives

the payee’s Direct Deposit payment.

FALSE STATEMENTS OR FRAUDULENT CLAIMS

Federal law provides a fine of not more than $10,000 or imprisonment for not more than five (5)

years or both for presenting a false statement or making a fraudulent claim.

1

1 2

2