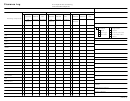

Settlement Statement

U.S. Department of Housing

OMB Approval No. 2502-0265

A.

(expires 11/30/2009)

and Urban Development

B. Type of Loan

6. File Number:

7. Loan Number:

8. Mortgage Insurance Case Number:

FHA

FmHA

Conv. Unins.

1.

2.

3.

VA

Conv. Ins.

4.

5.

C. Note: This form is furnished to give you a statement of actual settlement costs. Amounts paid to and by the settlement agent are shown. Items marked

“(p.o.c.)” were paid outside the closing; they are shown here for informational purposes and are not included in the totals.

D. Name & Address of Borrower:

E. Name & Address of Seller:

F. Name & Address of Lender:

G. Property Location:

H. Settlement Agent:

Place of Settlement:

I. Settlement Date:

J. Summary of Borrower's Transaction

K. Summary of Seller's Transaction

100. Gross Amount Due From Borrower

400. Gross Amount Due To Seller

101. Contract sales price

401. Contract sales price

102. Personal property

402. Personal property

103. Settlement charges to borrower (line 1400)

403.

104.

404.

105.

405.

Adjustments for items paid by seller in advance

Adjustments for items paid by seller in advance

106. City/town taxes

to

406. City/town taxes

to

107. County taxes

to

407. County taxes

to

108. Assessments

to

408. Assessments

to

109.

409.

110.

410.

111.

411.

112.

412.

120. Gross Amount Due From Borrower

420. Gross Amount Due To Seller

200. Amounts Paid By Or In Behalf Of Borrower

500. Reductions In Amount Due To Seller

201. Deposit or earnest money

501. Excess deposit (see instructions)

202. Principal amount of new loan(s)

502. Settlement charges to seller (line 1400)

203. Existing loan(s) taken subject to

503. Existing loan(s) taken subject to

204.

504. Payoff of first mortgage loan

205.

505. Payoff of second mortgage loan

206.

506.

207.

507.

208.

508.

209.

509.

Adjustments for items unpaid by seller

Adjustments for items unpaid by seller

210. City/town taxes

to

510. City/town taxes

to

211. County taxes

to

511. County taxes

to

212. Assessments

to

512. Assessments

to

213.

513.

214.

514.

215.

515.

216.

516.

217.

517.

218.

518.

219.

519.

220. Total Paid By/For Borrower

520. Total Reduction Amount Due Seller

300. Cash At Settlement From/To Borrower

600. Cash At Settlement To/From Seller

301. Gross Amount due from borrower (line 120)

601. Gross amount due to seller (line 420)

302. Less amounts paid by/for borrower (line 220)

(

) 602. Less reductions in amt. due seller (line 520)

(

)

303. Cash

From

To Borrower

603. Cash

To

From Seller

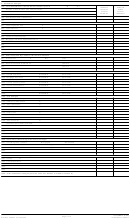

Section 5 of the Real Estate Settlement Procedures Act (RESPA) requires

Section 4(a) of RESPA mandates that HUD develop and prescribe this

the following: • HUD must develop a Special Information Booklet to help

standard form to be used at the time of loan settlement to provide full

persons borrowing money to finance the purchase of residential real estate

disclosure of all charges imposed upon the borrower and seller. These are

to better understand the nature and costs of real estate settlement services;

third party disclosures that are designed to provide the borrower with

• Each lender must provide the booklet to all applicants from whom it

pertinent information during the settlement process in order to be a better

receives or for whom it prepares a written application to borrow money to

shopper.

finance the purchase of residential real estate; • Lenders must prepare and

The Public Reporting Burden for this collection of information is estimated

distribute with the Booklet a Good Faith Estimate of the settlement costs

to average one hour per response, including the time for reviewing instruc-

that the borrower is likely to incur in connection with the settlement. These

tions, searching existing data sources, gathering and maintaining the data

disclosures are manadatory.

needed, and completing and reviewing the collection of information.

This agency may not collect this information, and you are not required to

complete this form, unless it displays a currently valid OMB control number.

The information requested does not lend itself to confidentiality.

form HUD-1 (3/86)

Page 1 of 2

Previous editions are obsolete

ref Handbook 4305.2

1

1 2

2