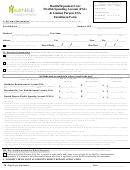

COUNTY OF VENTURA FLEXIBLE BENEFITS PROGRAM

DEPENDENT CARE FLEXIBLE SPENDING ACCOUNT CLAIM INSTRUCTIONS

When preparing your claim, be sure to keep photocopies of all bills or

other proof of eligible expense. The copies you send in cannot be returned.

1.

Read the Important Information section below. Expenses must be for an Eligible Dependent and must qualify for a federal tax return

credit in the current Plan Year. The dates of the Plan Year are from January 1 to December 31. You may only file claims for expenses

incurred (services received) in the same Plan Year that you made your contributions, and only for coverage periods for which

contributions were made. You cannot have claimed any other deduction or credit for this expense under the Internal Revenue Code.

The use of a Flexible Spending Account may eliminate the availability of a tax credit for dependent care. The County uses IRS

Publication 503 as a guide for determining eligible expenses under its Dependent Care Flexible Spending Account Program.

2.

Complete the unshaded sections of Parts I and II. Make no entries in the Accounting Data section.

3.

Attach supporting documentation to verify your expenses. Attach one or more of the following:

a.

A copy of your canceled check (front and back); or

b.

A dated receipt giving the dates the services were rendered (and the tax ID number (TIN) or Social Security Number (SSN), unless

it is a church school); or

c.

Your daycare provider’s signature, TIN or SSN, and date signed, in the Daycare Provider box in Part II of the form.

4.

Read the Employee Statement, sign the claim, and return the claim to the Benefits Unit of Human Resources for approval

(L#1970). Keep a copy for your records. Your claim will be processed for up to the amount available in your account on the date the

claim is processed. If that amount is less than the total amount of your eligible expense, it is your responsibility to submit a new

claim for the remaining eligible expense when additional contributions have been deposited to your account.

IMPORTANT INFORMATION

For this account, a “dependent” includes any person for whom

The daycare provider cannot be your spouse, son, stepson,

you provide over half of the financial support, even if you cannot

daughter, or stepdaughter under the age of 19 at the end of the

claim an exemption on your federal tax return. The dependent

calendar year in which the expense is incurred or paid, or any

must be:

individual who is a dependent of you or your spouse on your

federal tax return.

Under the age of 13, and you must be entitled to a

deduction under Internal Revenue Service (IRS) Code

You may claim before and after school care expenses, but

section 21, sub-sections (b)(1)(A) and (e)(5)(B) on the date

cannot claim the total cost of school expenses (i.e., tuition),

services are rendered; or

unless the child is in a grade level below kindergarten and

Over age 13, and physically or mentally unable to care for

schooling is incidental to and cannot be separated from the cost

himself or herself. If dependent care is provided outside the

of day care.

home, the dependent must spend at least eight hours each

day in your household.

Remember that the Plan Year ends on December 31. You may

only file claims for expenses incurred (services received) in the

Your spouse must work or attend school, or you must be

same Plan Year that you made your contributions, and only for

unmarried, and expenses claimed must be for a period in which

coverage periods when contributions were made.

you worked.

You have until April 15

of the following Plan Year to submit

th

The total amount of expenses claimed for the Plan Year cannot

claims against the current Plan Year’s account (i.e., turn in

exceed the earned income of the lower-paid spouse for the year

claims for Plan Year 2012 by April 15, 2013).

($3000 is assigned as earned income if that spouse attends

school).

For more information, review the Flexible Spending Account chapter of your Benefit Plans Handbook. If you

have further questions regarding this form, the instructions, or eligible expenses, please contact the Benefits

Unit of County of Ventura Human Resources (805-677-8785; ).

Rev 03/2012

1

1 2

2