Annual Exemption Request - City Of Portland Revenue Bureau

ADVERTISEMENT

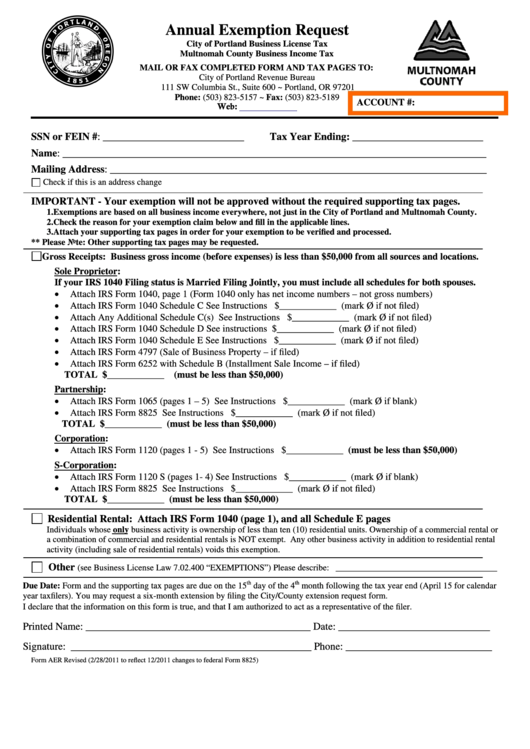

Annual Exemption Request

City of Portland Business License Tax

Multnomah County Business Income Tax

MAIL OR FAX COMPLETED FORM AND TAX PAGES TO:

City of Portland Revenue Bureau

111 SW Columbia St., Suite 600 ~ Portland, OR 97201

Phone: (503) 823-5157 ~ Fax: (503) 823-5189

ACCOUNT #:

Web:

SSN or FEIN #: ___________________________

Tax Year Ending: _________________________

Name: _________________________________________________________________________________

Mailing Address: ________________________________________________________________________

Check if this is an address change

IMPORTANT - Your exemption will not be approved without the required supporting tax pages.

1. Exemptions are based on all business income everywhere, not just in the City of Portland and Multnomah County.

2. Check the reason for your exemption claim below and fill in the applicable lines.

3. Attach your supporting tax pages in order for your exemption to be verified and processed.

** Please Note: Other supporting tax pages may be requested.

Gross Receipts: Business gross income (before expenses) is less than $50,000 from all sources and locations.

Sole Proprietor:

If your IRS 1040 Filing status is Married Filing Jointly, you must include all schedules for both spouses.

•

Attach IRS Form 1040, page 1 (Form 1040 only has net income numbers – not gross numbers)

•

Attach IRS Form 1040 Schedule C

See Instructions $____________ (mark Ø if not filed)

•

Attach Any Additional Schedule C(s)

See Instructions $____________ (mark Ø if not filed)

•

Attach IRS Form 1040 Schedule D

See instructions $____________ (mark Ø if not filed)

•

Attach IRS Form 1040 Schedule E

See Instructions $____________ (mark Ø if not filed)

•

Attach IRS Form 4797 (Sale of Business Property – if filed)

•

Attach IRS Form 6252 with Schedule B (Installment Sale Income – if filed)

TOTAL $____________ (must be less than $50,000)

Partnership:

•

Attach IRS Form 1065 (pages 1 – 5)

See Instructions $____________ (mark Ø if blank)

•

Attach IRS Form 8825

See Instructions $____________ (mark Ø if not filed)

TOTAL $____________ (must be less than $50,000)

Corporation:

•

Attach IRS Form 1120 (pages 1 - 5)

See Instructions $____________ (must be less than $50,000)

S-Corporation:

•

Attach IRS Form 1120 S (pages 1- 4)

See Instructions $____________ (mark Ø if blank)

•

Attach IRS Form 8825

See Instructions $____________ (mark Ø if not filed)

TOTAL $____________ (must be less than $50,000)

Residential Rental: Attach IRS Form 1040 (page 1), and all Schedule E pages

Individuals whose only business activity is ownership of less than ten (10) residential units. Ownership of a commercial rental or

a combination of commercial and residential rentals is NOT exempt. Any other business activity in addition to residential rental

activity (including sale of residential rentals) voids this exemption.

Other

(see Business License Law 7.02.400 “EXEMPTIONS”) Please describe: _____________________________________

th

th

Due Date: Form and the supporting tax pages are due on the 15

day of the 4

month following the tax year end (April 15 for calendar

year taxfilers). You may request a six-month extension by filing the City/County extension request form.

I declare that the information on this form is true, and that I am authorized to act as a representative of the filer.

Printed Name: ___________________________________________ Date: _____________________________

Signature: ______________________________________________ Phone: ____________________________

Form AER Revised (2/28/2011 to reflect 12/2011 changes to federal Form 8825)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2