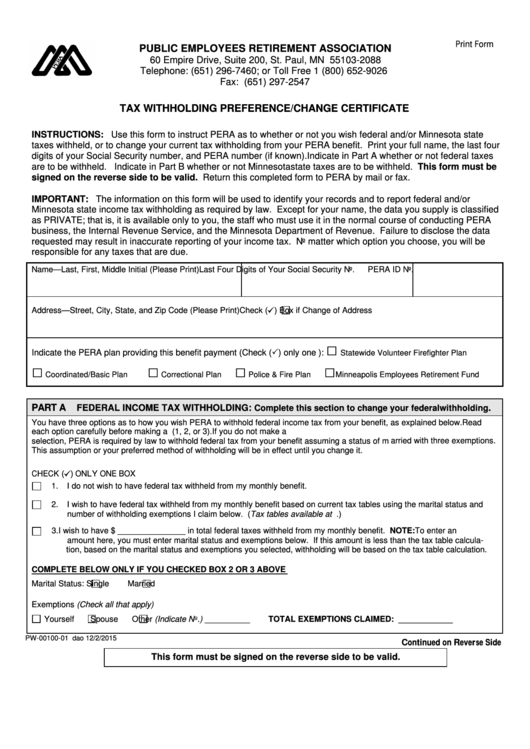

Print Form

PUBLIC EMPLOYEES RETIREMENT ASSOCIATION

60 Empire Drive, Suite 200, St. Paul, MN 55103-2088

Telephone: (651) 296-7460; or Toll Free 1 (800) 652-9026

Fax: (651) 297-2547

TAX WITHHOLDING PREFERENCE/CHANGE CERTIFICATE

INSTRUCTIONS: Use this form to instruct PERA as to whether or not you wish federal and/or Minnesota state

taxes withheld, or to change your current tax withholding from your PERA benefit. Print your full name, the last four

digits of your Social Security number, and PERA number (if known). Indicate in Part A whether or not federal taxes

are to be withheld. Indicate in Part B whether or not Minnesota state taxes are to be withheld. This form must be

signed on the reverse side to be valid. Return this completed form to PERA by mail or fax.

IMPORTANT: The information on this form will be used to identify your records and to report federal and/or

Minnesota state income tax withholding as required by law. Except for your name, the data you supply is classified

as PRIVATE; that is, it is available only to you, the staff who must use it in the normal course of conducting PERA

business, the Internal Revenue Service, and the Minnesota Department of Revenue. Failure to disclose the data

requested may result in inaccurate reporting of your income tax. No matter which option you choose, you will be

responsible for any taxes that are due.

Name—Last, First, Middle Initial (Please Print)

Last Four Digits of Your Social Security No.

PERA ID No.

[

Address—Street, City, State, and Zip Code (Please Print)

Check (

) Box if Change of Address

□

Indicate the PERA plan providing this benefit payment (Check () only one ):

Statewide Volunteer Firefighter Plan

□

□

□

□

Coordinated/Basic Plan

Correctional Plan

Police & Fire Plan

Minneapolis Employees Retirement Fund

PART A

FEDERAL INCOME TAX WITHHOLDING :

.

Complete this section to change your federal withholding

You have three options as to how you wish PERA to withhold federal income tax from your benefit, as explained below. Read

each option carefully before making a selection. Use a check mark to indicate your choice (1, 2, or 3). If you do not make a

selection, PERA is required by law to withhold federal tax from your benefit assuming a status of married with three exemptions.

This assumption or your preferred method of withholding will be in effect until you change it.

[

CHECK (

) ONLY ONE BOX

1.

I do not wish to have federal tax withheld from my monthly benefit.

2.

I wish to have federal tax withheld from my monthly benefit based on current tax tables using the marital status and

number of withholding exemptions I claim below. (Tax tables available at )

3. I wish to have $ _______________ in total federal taxes withheld from my monthly benefit. NOTE: To enter an

amount here, you must enter marital status and exemptions below. If this amount is less than the tax table calcula-

tion, based on the marital status and exemptions you selected, withholding will be based on the tax table calculation.

COMPLETE BELOW ONLY IF YOU CHECKED BOX 2 OR 3 ABOVE

Marital Status:

Single

Married

Exemptions (Check all that apply)

Yourself

Spouse

Other (Indicate No.) __________

TOTAL EXEMPTIONS CLAIMED: ____________

PW-00100-01 dao 12/2/2015

Continued on Reverse Side

This form must be signed on the reverse side to be valid.

1

1 2

2