Tuition Residency Reclassification Application

ADVERTISEMENT

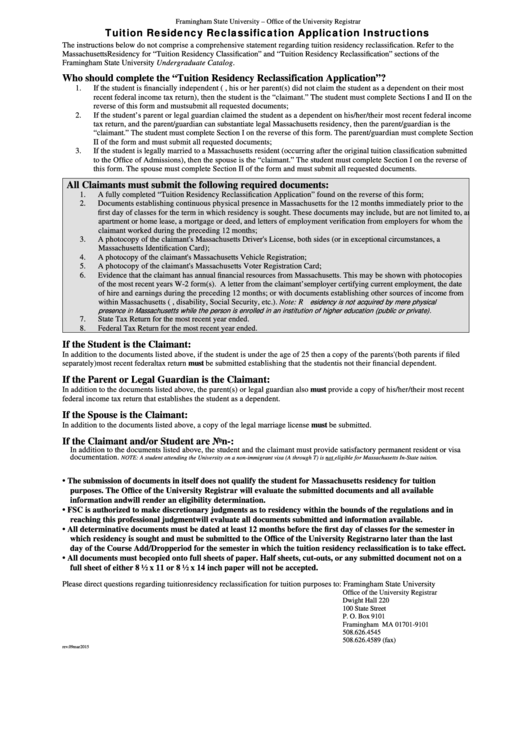

Framingham State University – Office of the University Registrar

Tuition Residency Reclassification Application Instructions

The instructions below do not comprise a comprehensive statement regarding tuition residency reclassification. Refer to the

Massachusetts Residency for “Tuition Residency Classification” and “Tuition Residency Reclassification” sections of the

Framingham State University Undergraduate Catalog.

Who should complete the “Tuition Residency Reclassification Application”?

1.

If the student is financially independent (i.e., his or her parent(s) did not claim the student as a dependent on their most

recent federal income tax return), then the student is the “claimant.” The student must complete Sections I and II on the

reverse of this form and must submit all requested documents;

2.

If the student’s parent or legal guardian claimed the student as a dependent on his/her/their most recent federal income

tax return, and the parent/guardian can substantiate legal Massachusetts residency, then the parent/guardian is the

“claimant.” The student must complete Section I on the reverse of this form. The parent/guardian must complete Section

II of the form and must submit all requested documents;

3.

If the student is legally married to a Massachusetts resident (occurring after the original tuition classification submitted

to the Office of Admissions), then the spouse is the “claimant.” The student must complete Section I on the reverse of

this form. The spouse must complete Section II of the form and must submit all requested documents.

All Claimants must submit the following required documents:

1.

A fully completed “Tuition Residency Reclassification Application” found on the reverse of this form;

2.

Documents establishing continuous physical presence in Massachusetts for the 12 months immediately prior to the

first day of classes for the term in which residency is sought. These documents may include, but are not limited to, an

apartment or home lease, a mortgage or deed, and letters of employment verification from employers for whom the

claimant worked during the preceding 12 months;

3.

A photocopy of the claimant's Massachusetts Driver's License, both sides (or in exceptional circumstances, a

Massachusetts Identification Card);

4.

A photocopy of the claimant's Massachusetts Vehicle Registration;

5.

A photocopy of the claimant's Massachusetts Voter Registration Card;

6.

Evidence that the claimant has annual financial resources from Massachusetts. This may be shown with photocopies

of the most recent years W-2 form(s). A letter from the claimant’s employer certifying current employment, the date

of hire and earnings during the preceding 12 months; or with documents establishing other sources of income from

esidency is not acquired by mere physical

within Massachusetts (e.g., disability, Social Security, etc.). Note: R

presence in Massachusetts while the person is enrolled in an institution of higher education (public or private).

7.

State Tax Return for the most recent year ended.

8.

Federal Tax Return for the most recent year ended.

If the Student is the Claimant:

In addition to the documents listed above, if the student is under the age of 25 then a copy of the parents' (both parents if filed

separately) most recent federal tax return must be submitted establishing that the student is not their financial dependent.

If the Parent or Legal Guardian is the Claimant:

In addition to the documents listed above, the parent(s) or legal guardian also must provide a copy of his/her/their most recent

federal income tax return that establishes the student as a dependent.

If the Spouse is the Claimant:

In addition to the documents listed above, a copy of the legal marriage license must be submitted.

If the Claimant and/or Student are Non-U.S. citizens:

In addition to the documents listed above, the student and the claimant must provide satisfactory permanent resident or visa

documentation.

NOTE: A student attending the University on a non-immigrant visa (A through T) is not eligible for Massachusetts In-State tuition.

• The submission of documents in itself does not qualify the student for Massachusetts residency for tuition

purposes. The Office of the University Registrar will evaluate the submitted documents and all available

information and will render an eligibility determination.

• FSC is authorized to make discretionary judgments as to residency within the bounds of the regulations and in

reaching this professional judgment will evaluate all documents submitted and information available.

• All determinative documents must be dated at least 12 months before the first day of classes for the semester in

which residency is sought and must be submitted to the Office of the University Registrar no later than the last

day of the Course Add/Drop period for the semester in which the tuition residency reclassification is to take effect.

• All documents must be copied onto full sheets of paper. Half sheets, cut-outs, or any submitted document not on a

full sheet of either 8 ½ x 11 or 8 ½ x 14 inch paper will not be accepted.

Please direct questions regarding tuition residency reclassification for tuition purposes to: Framingham State University

Office of the University Registrar

Dwight Hall 220

100 State Street

P. O. Box 9101

Framingham MA 01701-9101

508.626.4545

508.626.4589 (fax)

rev.09mar2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2