Obamacare Tax Form Exemptions Questionnaire Page 2

ADVERTISEMENT

ACA “Exemptions” Questionnaire Instructions and Review.

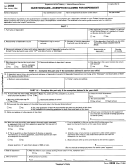

Line 61 Form 1040 has two choices. Either you had full year coverage for everyone listed on the tax return, or you

have to file Form 8965.

Form 8965 has only three parts. Part I is for clients that have an exemption certificate, Part II is for clients that fall

below the filing threshold based on their filing status, and Part III is for clients that qualify for an exemption but for

which they don’t have to apply for an exemption certificate. This form is only for describing the exemption, the

computation and penalty if any is shown on the ACA Worksheet.

Everything starts with the “ACA Worksheet”.

An “x” put in the “None” box means the person had no insurance at all during the year,

An “x” put in the “Mkt” box means they have been granted either a hardship exemption or religious exemption

from the Marketplace,

An “x” put in the “Exm” box means they qualify for one of the exemptions allowed on the Form 1040,

An “x” in any box other than “Full” will then go to Form 8965. And let the fun begin.

There are 14 Hardship exemptions granted by the Marketplace. See attached list and what proof must be provided to

get the exemption. You can share this with the client. I would not attempt to complete the application process, but

that’s up to you.

To request a Hardship exemption, you would

goto “healthcare.gov”,

click on “Get Answers”

click on “Fees & exemptions”,

and then chose which exemption you are applying for.

Affordability Worksheets for ►Code A and ►Code G

TW has a real nice ACA Worksheet for Form 8965, but you have to check the box “Exm” if the taxpayer

or dependent qualifies for an exemption. Most are self explanatory, but they will never know if they fit

into the affordability exemption, you will have to determine that.

There are two worksheets in the instructions for Form 8965, the “Affordability Worksheet” on page 10 for

►Code G and the “Marketplace Coverage Affordability Worksheet” on page 11 for ►Code A.

Neither of which are included in the TW software. If you are going to use these, you must start with

the “Affordability Worksheet” and if directed, go to the “Marketplace Coverage Affordability

Worksheet”. From discussions with TW, they thought the cost would be prohibitive considering they

did not think many taxpayers would qualify.

The “Affordability Worksheet” is used for persons who have insurance available at work but they chose

not to purchase it, and for this worksheet they will need to know the lowest cost of each self-only plan

offered by the employer(s), good luck with them knowing that.

The “Marketplace Coverage Affordability Worksheet is for persons who do not have insurance plans

available at work, for that you will need the lowest cost bronze plan for line 1 which is $247 and the

second lowest cost silver plan for line 10 which is $322. These are for zip code 46227. Each zip code

is different. Go to “healthpocket.com”, enter your client’s zip code, and you can get the exact cost.

I would guess everyone will be able to determine the affordability without the worksheets. I would do it on a scratch

sheet and include that in with your notes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Medical

1

1 2

2 3

3