Va Form 21-0517-1 - Improved Pension Eligibility Verification Report (Veteran With Children) Page 2

ADVERTISEMENT

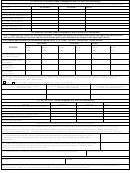

7A. MONTHLY INCOME (Read Paragraphs 2 and 3 of the EVR Instructions)

GROSS MONTHLY AMOUNTS (If no income was received from a particular source, write "0" or "none." DO NOT LEAVE ANY ITEMS BLANK.)

SOURCE

VETERAN

SPOUSE

CHILD:

SOCIAL SECURITY

U.S. CIVIL SERVICE

U.S. RAILROAD RETIREMENT

BLACK LUNG BENEFITS

MILITARY RETIREMENT

OTHER (Show Source)

OTHER (Show Source)

OTHER (Show Source)

7B. ANNUAL INCOME (Read Paragraphs 2 and 4 of the EVR Instructions)

NOTE: Report annual income for the dates indicated. If no dates are above the columns that follow, then report last calendar year

(January thru December) income in the left-hand column and current calendar year income in the right-hand column.

If no income was received from a particular source, write "0" or "none." DO NOT LEAVE ANY ITEMS BLANK.

VETERAN

SPOUSE

CHILD:

FROM:

FROM:

FROM:

FROM:

FROM:

FROM:

SOURCE

THRU:

THRU:

THRU:

THRU:

THRU:

THRU:

GROSS WAGES FROM

ALL EMPLOYMENT

$

$

$

$

$

$

TOTAL INTEREST AND

DIVIDENDS

ALL OTHER

(Show Source)

ALL OTHER

(Show Source)

7C. DID ANY INCOME CHANGE (Increase/Decrease) DURING THE PAST 12 MONTHS? (Answer "NO" if there were no income changes or if the

only change was a Social Security/VA cost-of-living adjustment. Answer "YES" if there were any other income changes or if you received any

NEW source of income or any ONE-TIME income)

YES

NO

(If "YES," complete Items 7D through 7F. If "NO," go to Item 7G.)

7D. WHAT INCOME CHANGED? (Show what

7E. WHEN DID THE INCOME CHANGE?

7F. HOW DID INCOME CHANGE? (Explain

income changed; for example, wages,

(Show the dates you received any new income or

what happened; for example, quit work,

city pension, etc.)

the date income changed)

got raise, received inheritance)

7G. NET WORTH (Read Paragraph 5 of the EVR Instructions)

SOURCE

VETERAN

SPOUSE

CHILD:

CASH/NON-INTEREST-BEARING BANK ACCOUNTS

$

$

$

INTEREST-BEARING BANK ACCOUNTS

IRA’S, KEOGH PLANS, ETC.

STOCKS, BONDS, MUTUAL FUNDS, ETC.

REAL PROPERTY (Not your home)

ALL OTHER PROPERTY

8. MEDICAL EXPENSES (Read Paragraph 6 of the EVR Instructions)

If you are using this form as your annual Eligibility Verification Report and Paragraph 6 of the EVR Instructions indicates that you should report

medical expenses, use VA Form 21-8416, Medical Expense Report. If you are using this form as a supplement to a pending claim, you do not

need to report medical expenses. If entitlement is established, you will have an opportunity to report your medical expenses at the end of the year.

9. VETERAN’S EDUCATIONAL AND VOCATIONAL REHABILITATION EXPENSES (Read Paragraph 7 of the

EVR Instructions) Show amounts paid by you during the past 12 months. DO NOT REPORT DEPENDENTS’

EXPENSES.

$

10. FAMILY MAINTENANCE (Hardship) EXPENSES FOR THE NEXT 12 MONTHS (Read Paragraph 8 of the EVR

Instructions). Complete ONLY IF VA is currently excluding children’s income on the grounds of hardship. Show

total family expenses expected for the next 12 months.

$

11A. SIGNATURE OF VETERAN (Read Paragraph 9 of the EVR Instructions before signing)

11B. DATE SIGNED

11C. TELEPHONE NUMBERS (Include Area Code)

DAYTIME

EVENING

PENALTY The law provides severe penalties which include fine or imprisonment or both, for the willful submission of any statement or evidence

of a material fact, knowing it is false, or fraudulent acceptance of any payment to which you are not entitled.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2